RIO DE JANEIRO, BRAZIL – Surrounded by mistrust, Boeing begins 2020 by changing its CEO and facing the greatest crisis in its 103 years of existence.

A new series of documents sent by the company to the US Congress shows that employees knew of the risks presented by the model 737 MAX during the aircraft certification process.

In the messages, the pilots talk about flaws in the aircraft’s simulators in the flight control system, the MCAS (Maneuverability Enhancement System), suspected to be the origin of the two crashes that killed 346 people in Ethiopia and Indonesia.

Despite the turbulent period experienced by Boeing, industry analysts believe that the context will not hinder its merger with Embraer.

In early 2019, Boeing advised it would purchase 80 percent of the control of Embraer’s commercial aviation business for US$4.2 (R$17) billion. In a transaction similar to the one between Airbus and Bombardier, the companies are still waiting for authorization from regulators to close the deal.

William Castro Alves, the chief strategist at Avenue Securities, argues that Boeing has operations in other niches and that this may sustain the company’s revenues during the crisis, allowing the merger to proceed.

“A relevant part of the company’s results comes from Boeing’s military business. In 2018 [before the crisis], the civil aviation segment accounted for 56 percent of revenues, that is, there are 44 percent less directly affected by the 737 issue,” Alves says.

Arthur Siqueira, a partner and investment analyst at GEO Capital, which specializes in investments abroad, believes that the next few years will not be easy for Boeing, but if the 737 MAX veto is overcome, the company can quickly reverse the situation.

“It is weakening because it is not managing to sell the planes or maintain the production level of the 737 MAX program, which is very important for the company. But looking at the industry as a whole, the future of commercial aviation over the next 20 years for aircraft that operate shorter flights is still based on Boeing’s 737 and Airbus’ A320,” he says.

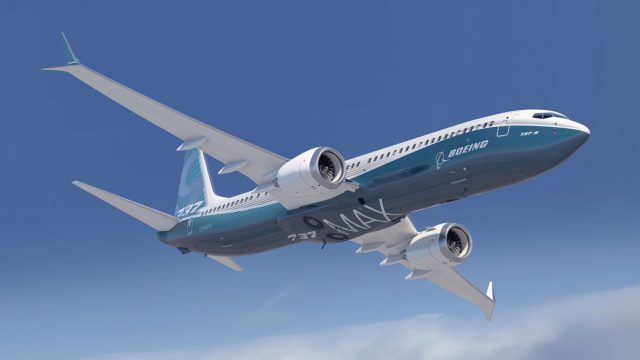

737 MAX, the problem

According to investigations, an aircraft flight angle correction software called MCAS may be accountable for both tragedies. In addition to the system’s vulnerability, the lack of pilot training in situations where the device was triggered is also pointed out as another cause for the crashes.

Involved in two accidents, the aircraft has been banned from flying around the world since March last year and, meanwhile, the company is going through several challenges regarding the safety of its main model.

The FAA (US Federal Aviation Regulatory Agency) says Boeing knew of the risk involved in its 737 MAX system, as a 2016 conversation between two of the company’s pilots showed that the MCAS made it difficult to fly the plane on a simulator.

In addition to the allegations, is the concealment of the aircraft’s flight manual software and the omission of information and documents regarding the aircraft’s manufacturing defects from the US agency, from the airlines that purchased model units and from pilots.

Company reaction

Unable to sell the 737 MAX, which represents 80 percent of all the multinational’s stock orders, Boeing temporarily suspended production of the aircraft and stopped delivery of the planes, which cost approximately US$121.6 million each.

According to Reuters, the worldwide veto on the model has already cost Boeing over US$9 billion, a figure that could increase as it relies on authorization from regulators.

To offset the time the model takes to be restructured and discussions about project failure, Boeing continues to close deals with the 737 MAX operators. Southwest Airlines, the world’s largest 737 operator, confirmed in December that it has closed a financial deal with the manufacturer.

In Brazil, Celso Ferrer, Gol’s vice president of operations, said the airline is waiting until March to solve the deadlock involving the aircraft, so it can start operating with the 737 MAX in April; Gol expects to receive compensation soon.

Since the last accident with the model in March 2019, the price of Boeing’s shares has dropped by about 20.4 percent. Boeing’s operating profit in the first nine months of 2019 also fell 97 percent compared to the same period in 2018.

The company still has to pay part of its debts and finance dividends to shareholders even though it recorded in its last reported results (third quarter) a 53 percent decrease in profit for the period and a negative cash flow of US$2.89 billion.

With the delay in resuming operation of the model, Boeing is considering increasing its debt volume as a way to bolster the company’s cash flow, according to the Dow Jones Newswires agency.

In the midst of this critical moment, the company is preparing to change its CEO. David Calhoun, the company’s head of the board of directors, replaces Dennis Muilenburg in office with the expectation of regaining confidence with regulators and improving the company’s image, governance and finances.

For Siqueira, the choice of Calhoun, from GEO Capital, is the result of the transparency strategy that the company has adopted to face the crisis. Since 2009 at Boeing, the executive is very familiar with the company and its business and a veteran of managing companies in crisis.

Calhoun is co-author of the book, “How Companies Win”, and says that being sincere is part of a leader’s characteristics, an approach that opposes, according to some critics, the company’s initial stance in the 737 MAX investigation process.

“The second you enter the office until the second you leave, every interaction is judged. You try to hide something from everyone and I think your body language becomes perfectly apparent,” he said in a video published in 2014 by the Jack Welch Management Institute.

Disbelieving Analysts

Unable to find a prompt solution to the 737 MAX issue, the company’s stock target prices continue to be lowered by several analysts.

On Wednesday, January 8th, investment bank Cowen reduced the target price from US$419 to US$371 and changed the recommendation from buy to neutral. The bank was one of the few institutions that saw an optimistic short-term future for the company.

According to Cai von Rumohr, a Cowen analyst, the MAX crisis will have a cascading effect on deliveries and this will increase the amount that Boeing will have to pay in compensation to its customers. “Our guess is that the total compensation could reach from US$10 to 14 billion,” von Rumohr said in a report.

The alarming figures and latest developments, according to David Spring, a professor at the University of Washington, could drive the company into bankruptcy.

In a document published in May, the professor said the aircraft in question was “designed to crash” – and soon, no one in the world will want to fly in a Boeing. “Boeing continues to prioritize short-term profit for the company over people’s safety,” Spring wrote.

For now, this is an isolated analysis. While analysts are concerned and reviewing projections, only a minority of those who monitor the company recommend selling their shares. Only three of the analysis houses on the Bloomberg monitor have this recommendation for shares (10.3 percent), against ten that recommend buying (34.5 percent) and 16 for holding (55.2 percent).

Source: Infomoney