By Ligia Martoni

The physical space already exists. It is on Curitiba’s Federation of Industries of Paraná (Fiep) campus.

A large hall, surrounded by laboratories equipped with cutting-edge equipment and researchers trained to revolutionize the automotive segment in Brazil.

Besides the facilities, there is already a lot of technology research.

Now, the green light is missing to start implementing what will be the first pre-industrial plant to manufacture lithium-ion batteries for electric vehicles in the country.

And, if everything goes as expected, by 2026, the first batch of this type of 100% national battery should be ready for the market.

The project is from the Senai Innovation Institute, part of the Fiep System.

A research center that was born from the need to create solutions to make the industry more competitive.

One of its fronts is the energy industry, and batteries, especially, are one of the strong points in the electrochemistry sector.

Since its inception in 2018, the institute has evolved in research to master the application of different materials, such as niobium, aluminum, and copper, to produce batteries for various uses – including automotive ones.

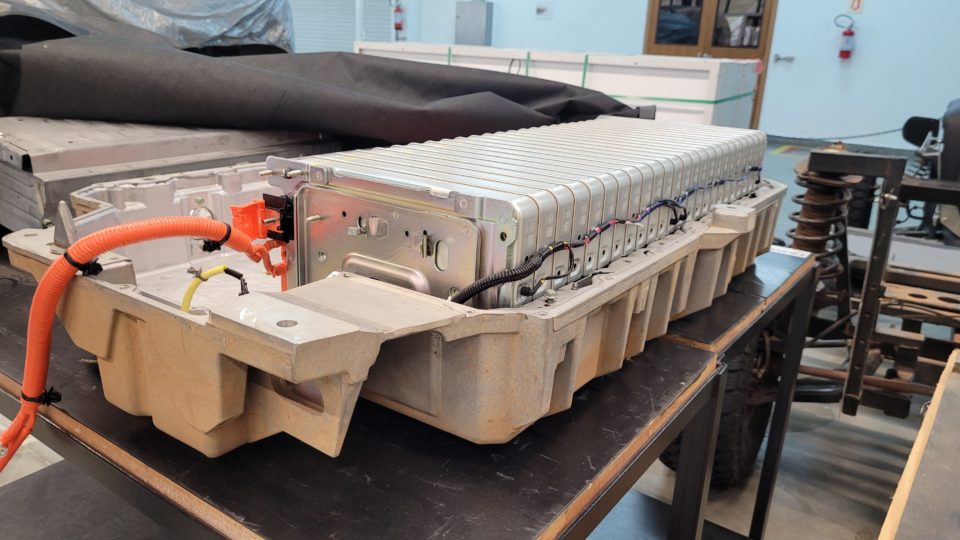

The most important step in this front should be the implementation of the new plant, which will be equipped with the necessary infrastructure and industrial equipment to produce “pioneer batches” of batteries.

“These lots would be composed of small quantities, such as 100, 200, or 300 batteries, produced for testing and validation purposes,” explains Marcos Berton, head researcher of electrochemistry at the Senai Innovation Institute.

The unit must move from the laboratory scale to reach industrial standards.

“We are going to an operational scale, level 7, to the point of producing the battery ready to be put into a vehicle,” explains the researcher, referring to the Technology Readiness Level (TRL).

The index is used to assess the progression of technology from the research and development phase to market implementation.

Stage 7 is one of the last and concerns the demonstration of the product in an operational environment.

In other words, the way the industry can reproduce it.

INVESTMENTS AND SUPPORT FROM OTHER INDUSTRIES SHOULD GUARANTEE THE VALUE CHAIN

Initially, R$64 million will be invested in the project from the Rota 2030 Ministry of Development, Industry, Commerce, and Services (MDIC) program.

The endeavor has the support of at least 20 industries installed in Brazil, ranging from mining to automotive, to ensure the development of the so-called “value chain” of the business.

“The proposal is to use national materials, test the cells, assemble the packs (a set of cells that form a battery), validate and approve them.”

“When we have this plant here, showing that we know how to make batteries, it is a matter of time to get national or international investors to set up a manufacturing unit in Brazil without depending on foreign inputs,” anticipates Berton.

Currently, the implementation of the unit is only waiting for the MDIC’s signature to make the project viable through the National Senai.

After that, the institute must proceed to the specification and purchase of the equipment needed to operate the plant, which should take about two years.

With this, it is expected that everything will be working, with the assembly of car batteries in full size, by 2026.

“We expect that within this project execution period, there will already be a company setting up its manufacturing unit,” says the chief researcher, based on the bet of having a product that can be a source of investment by interested partner industries.

ADVANCED RESEARCH IN BATTERIES

Mastering the technology will allow battery manufacturing companies to guarantee 100% national production.

Today, even if Brazil produces high-value-added material to compose the batteries, manufacturing the cells is all done abroad.

But even getting to this material was a challenge, which also relied on the research developed in Curitiba.

Recently, Senai-PR signed a consortium with 11 manufacturers of lead-acid batteries used in start-stop vehicles, a model that turns on and off when the car stops.

The result was 15% fuel savings, with a more competitive product already being manufactured by 4 of the 11 participating industries – mostly small and medium-sized.

With the growing market interest in electromobility, the researchers began to map global trends and initiate research projects to understand batteries for electric vehicles better.

NIOBIUM MINING COMPANY INVESTS IN THE BATTERY MARKET

During this process, the institute received a visit from the Brazilian company CBMM, a global leader in producing and commercializing niobium products.

The company, headquartered in Araxá (MG), is an expert in niobium technology and decided to invest in the project to develop compounds for battery application.

“In these first three years of development, we showed CBMM that niobium conferred interesting properties, such as fast recharging,” explains the researcher.

The institute has become one of the innovation fronts of the company, with over 40 projects in partnerships with universities and research institutes worldwide.

It develops technologies with niobium oxides for advanced lithium-ion batteries, which allow ultrafast recharging, as well as greater stability, lower risk of explosion, and longer life.

For the lithium-ion battery front alone, CBMM allocated R$72 million in 2022.

In 2023, investments to accelerate new developments in battery materials should reach R$94 million.

This year, the company should present a project with Volkswagen Trucks and Buses and Toshiba, which will apply a fast recharge battery, in less than 10 minutes, in an electric bus.

“The battery will be made in Japan, but the material that gives this fast recharging property is produced in Brazil with high added value,” he says.

RESEARCHERS ALSO WORK WITH OTHER MATERIALS

The researchers at Senai-PR are also working with research on other materials to compose the batteries for electric vehicles, such as aluminum and copper.

In the case of copper, the challenge is to develop sheets of adequate thickness for vehicular use, the so-called electrolytic copper sheets.

Although Brazil already produces copper sheets at 50 micrometers, they must reach a maximum of 9 micrometers for electromobility.

“The country still doesn’t have the machinery to reduce the thickness of the sheet, and such a machine costs US$19 million.”

“That is why we are proposing a group of companies that works with these sheets so that we can develop a manufacturing process in this thickness”, he adds.

This could also be used for other applications like 5G technology cell phones.

WHEN WILL THIS REACH THE CONSUMER?

If everything goes right and so many different technologies converge to create alternatives in the composition of batteries for electric vehicles, the tendency is that the market will grow, finally making the predictions of reducing the price of the electric car significantly come true.

Currently, batteries represent 45% of the vehicle’s value.

“Therefore, Brazil needs to master the manufacturing technology of these batteries and their inputs, including mining,” says Marcos Berton.

And here comes an important point.

Mining represents about 3% of the national GDP today and may reach 5% due to the battery demand, besides being responsible for 50% of Brazil’s positive trade balance.

“Therefore, it is crucial to encourage mining in the country and take advantage of the opportunities to transform these commodities.

“We will not stop exporting ore, but we must make it possible for at least part of it to become high-value-added material. And with material and technological domination, we will have the possibility of ‘n’ applications”, he evaluates.

New applications attract the industry, which produces more and becomes more competitive.

The result is a reduction, in the end, in the cost to the consumer.

It is not possible to say yet, how much this reduction will be, nor when it will come in such significant percentages, to the point of leaving the electric car on an equal footing – or almost – with the combustion vehicle.

“We are not thinking about the price yet because we have to master the technology.”

“Once that happens, it is a matter of time (to cheapen) because the market dictates the price.”

“But if we consider only the exchange rate variation and the import transportation values, which are very high, we can already guarantee that we will have cheaper batteries.”

RECYCLING AND SECOND LIFE

If the production of batteries for electric vehicles is going to increase, the solution for dealing with them at the end of their useful life needs to accompany this expansion.

With an eye on circular economy and carbon footprint reduction, the institute is already working on recycling lithium-ion batteries.

For Marcos Berton, if more than 99% of the lead-acid batteries are recycled in the country, there is no reason not to do the same with the others.

In a joint project with BMW Group Brazil and the metallurgical company Tupy, Senai-PR recovers all the elements present in the ion cells of electric vehicles, making it possible to manufacture new batteries.

The hydrometallurgy process extracts the battery components, which uses the liquid medium to separate the materials and then make them solid again.

In the institute’s laboratories, researchers are already working on recycling batteries from retired BMW i3 vehicles.

The goal is that, eventually, there will be a large-scale national industry dedicated to this purpose.

“It’s a complete service, aiming at a sustainable life cycle for the batteries,” guarantees Berton.

Before recycling, it is still possible to give a second use to the batteries that are no longer useful for cars.

“They can be used to store energy,” he says, anticipating a need for distributed generation that, like cars, is still hindered by the price of storage systems.

A double solution for convergent challenges.

With information from Gazeta do Povo

News Brazil, English news Brazil, Brazilian industry