By Scott Squires and Karl Lester

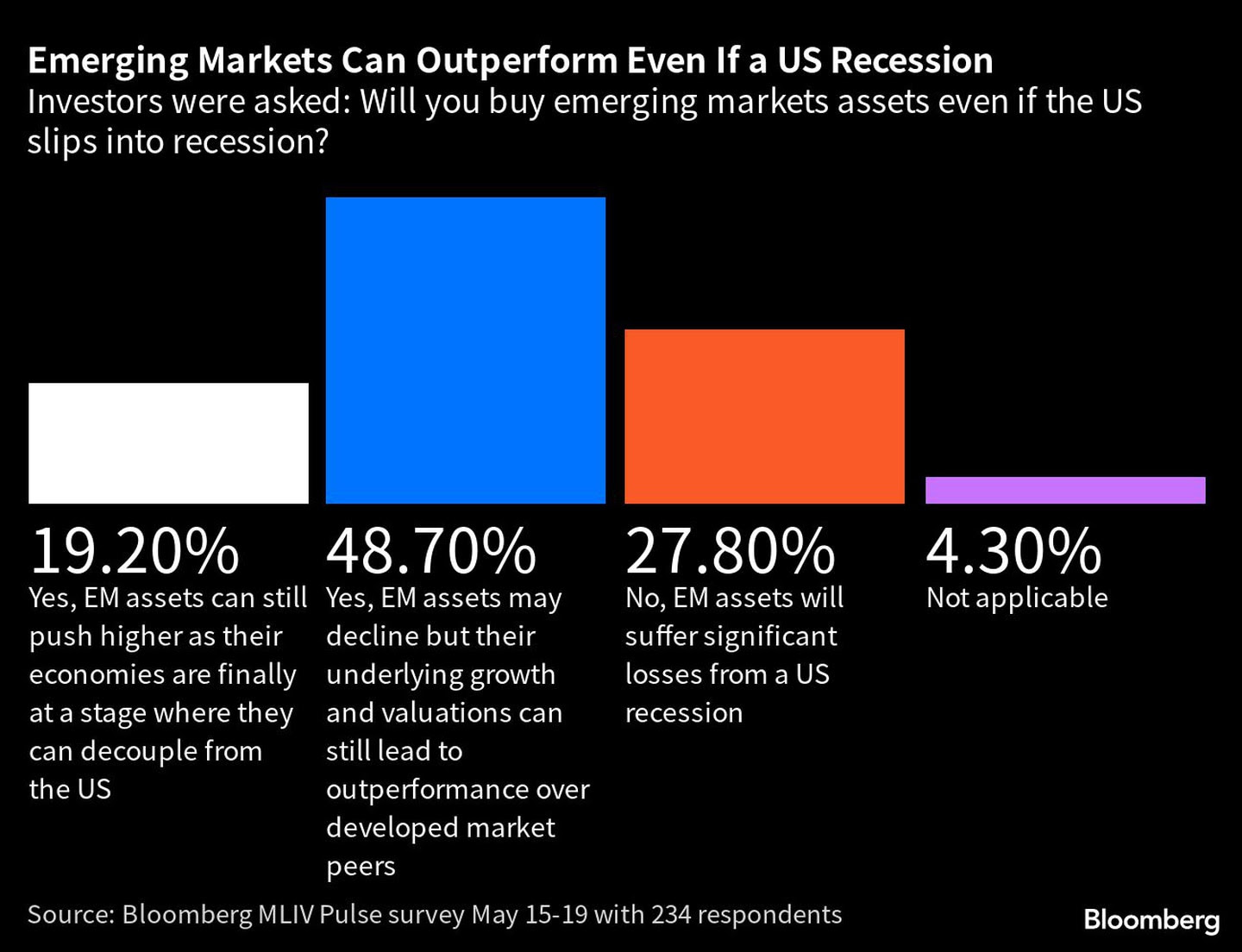

Wall Street investors plan to increase bets on emerging markets, according to Bloomberg’s latest Markets Live Pulse survey, in a sign that the asset class has become a favorite for those who fear the fallout from a recession in the United States.

Some 61% of the 234 investment managers, analysts, and traders surveyed said they expect to increase exposure to assets in developing countries over the next 12 months, even as concern over a possible slowdown in the US economy and uncertainty about the Federal Reserve’s next interest rate moves grow.

The emerging asset class, they say, offers protection in case the US central bank’s push against inflation leads the US into a recession.

“Developing country economies are much more resilient today than they were 30 years ago, and emerging market central banks have been much more responsible in dealing with rising inflation than the developed world,” said Justin Leverenz, who manages the US$26 billion Invesco Developing Markets Fund, one of the world’s top-performing emerging country equity funds this year.

“There is significant value in the whole emerging markets landscape,” he said.

“Over the last 10 years, emerging economies have become more resilient, and global investors have almost entirely overlooked them.”

Some 49% of respondents said that even if a US recession causes a decline in emerging assets, their underlying growth and attractive valuations will still help them outperform other mature markets.

Malcolm Dorson, manager at Global X Management in New York, said emerging markets are better positioned than the major economies after the pandemic.

This is helping certain developing countries avoid the same kind of policy and hangover that threatens the US and Europe after the stimulus measures adopted during the pandemic.

“We see underlying growth potential improving for emerging markets, valuations are cheap, and the long-term attraction of emerging markets remains unchanged,” said Devan Kaloo, global head of emerging markets at Abrdn.

ASSETS FAVORED

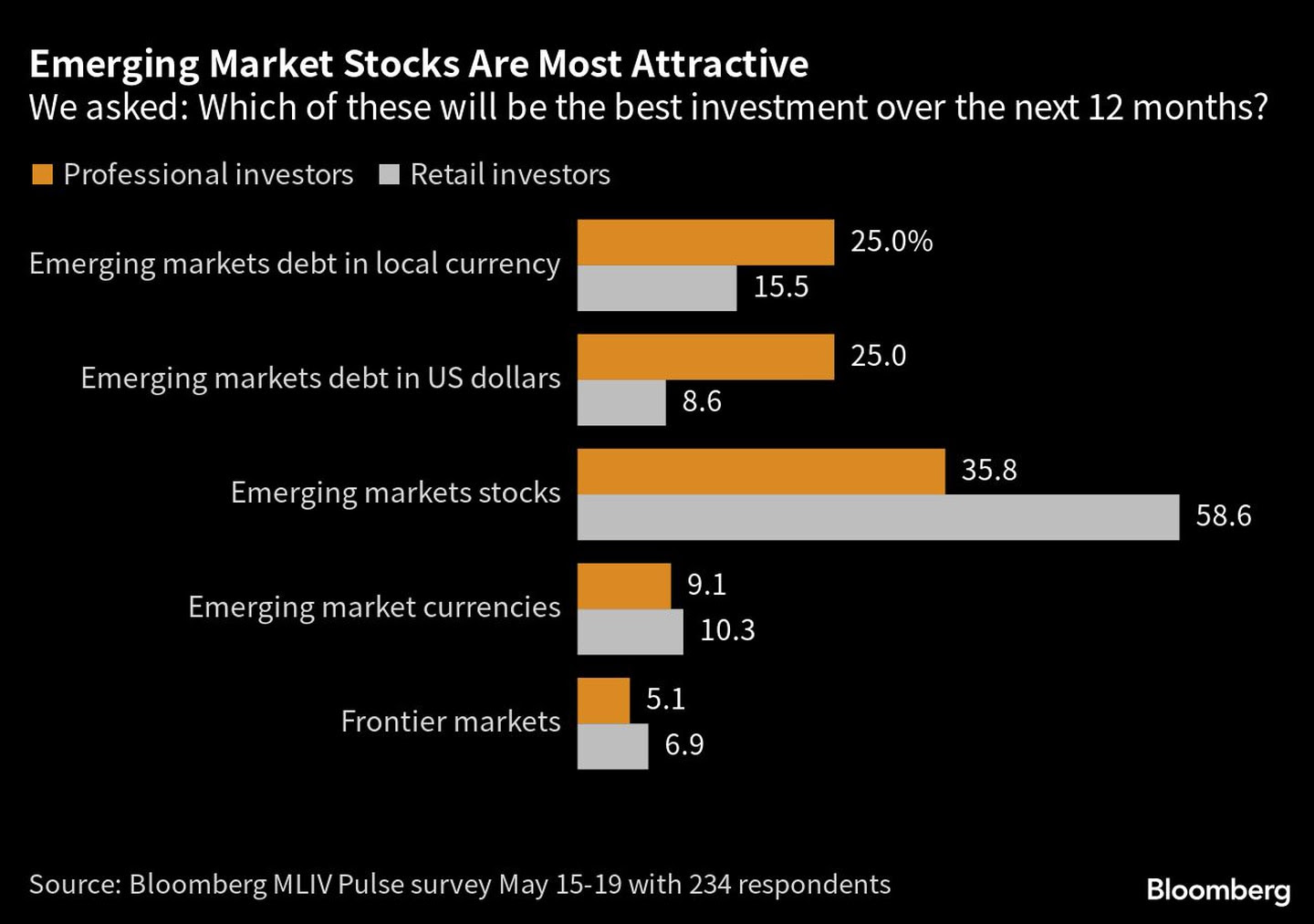

Relative outperformance, the survey shows, is likely to come from equities.

41% of respondents said equities are the best investment choice in emerging markets over the next 12 months.

At least some of that optimism comes down to relative opportunity.

The MSCI Emerging Markets Index is up just 2.2% this year, compared with a 9.2% gain in a similar gauge of developed market equities.

“We need emerging economies that can sustain reasonable levels of potential output and businesses that can create value,” said Lewis Kaufman, whose US$3.7 billion fund (Artisan Developing World Fund) has outperformed 99% of US-based peers this year.

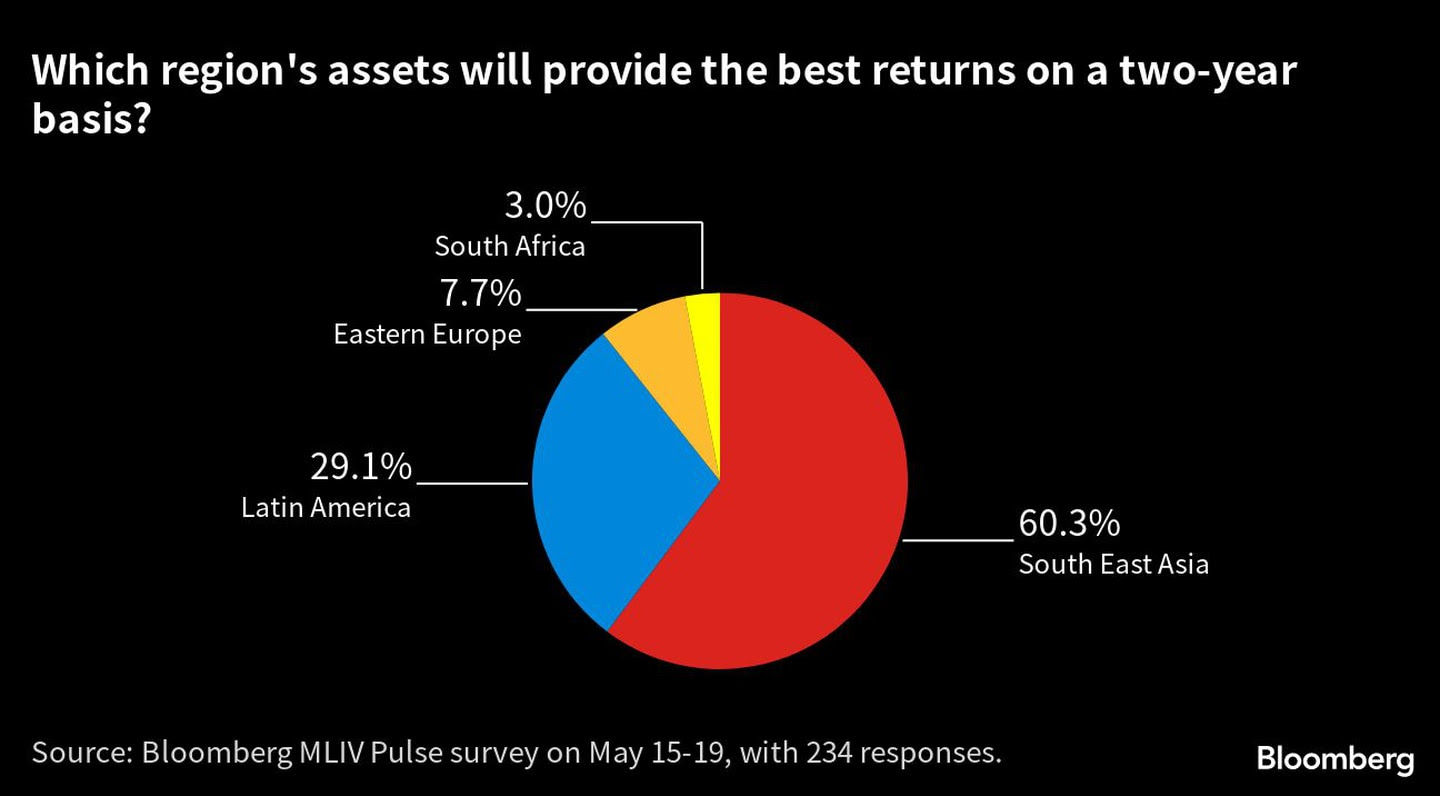

Regarding geography, respondents also took advantage of opportunities in Southeast Asia.

Most respondents said assets in the region would provide the best returns in emerging markets on a two-year basis.

“Southeast Asia is one of the best places for long-term investors,” said Aninda Mitra, macro and investment strategist at BNY Mellon Investment Management in Singapore.

“There is a track record of solid macroeconomic management, better demographics, and an increasing flow of foreign direct investment.”

Economic growth is normalizing as China’s economy reopens and industry expands, according to Alexander Davey, head of the global capacity for active equities at HSBC Asset Management. Goldman Sachs, meanwhile, pointed to opportunities in Thai bank stocks.

Of those who responded to the Bloomberg survey conducted May 15-19, about 65% were in Europe or North America.

About 19% said they were based in Asia.

Most respondents identified themselves as portfolio managers, retail investors, or strategists.

The MLIV Pulse is a weekly survey of Bloomberg News readers at the terminal and online, conducted by Bloomberg’s Markets Live team, which also runs a 24/7 MLIV blog at the terminal.

*With contributions from Netty Ismail and Srinivasan Sivabalan

With information from Bloomberg

News Brazil, English news Brazil, Brazilian investment