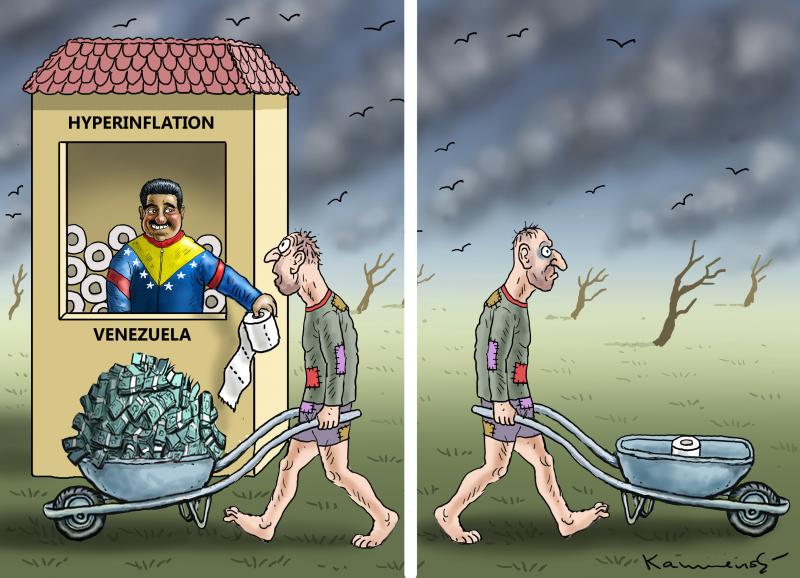

The Chavista regime failed to stabilize the economy and economic activity, despite multiple programs launched since 2019.

The last stabilization attempt started between March and April 2021 and lasted until July 2022.

But the program is completely exhausted, and Venezuela is going through a new inflationary outburst.

The Venezuelan Observatory of Finance (OVF) confirmed that retail prices climbed by 20.2% in February 2023 with respect to the preceding period, after having risen by as much as 39.2% in January and 37.2% in December 2022.

Monthly price increases averaged 29.6% since November, evidencing a violent acceleration compared to the 4.6% average observed between November 2021 and February 2022.

Year-on-year inflation increased again and represented 537.7% compared to February 2022, returning to the highest level of the last two years.

February was the sixth consecutive month of increase in the interannual inflation rate, and this metric accumulated a jump of almost 423 percentage points compared to the inflation observed in August 2022 (estimated at 114.1%, according to the OVF).

Venezuela accumulated an inflationary jump of 67.7% in the first two months of 2023.

Average prices for health care increased by 15.8% in February, clothing rose by 13.5%, and household equipment and maintenance items increased by 15.1%.

Suffocated by the terrible fiscal situation, Maduro was forced to eliminate direct economic subsidies on public utility rates for electricity, water distribution, urban cleaning, and telecommunications.

This caused a rearrangement of relative prices that shot up the price of tariffs by a weighted average of 156.3% at the end of February and was the item with the highest monthly increase recorded.

THE FAILED STABILIZATION ATTEMPT BETWEEN 2021 AND 2022

Nicolás Maduro’s regime implemented a series of measures to try to stabilize the country’s nominal rate, although again, the attempts failed.

As of May 2019, Venezuela eliminated the old exchange control system of the Chávez era, given the collapse of the Central Bank as the regulator of the foreign exchange market.

Most of the foreign exchange transactions were liberalized in an unfolded exchange market.

Under this exchange rate scheme, between 2021 and 2022, the authorities decided to adopt the following measures to stabilize prices:

- The intervention of the free exchange rate to contain inflationary expectations, limiting monthly devaluation.

- The new tax on foreign exchange transactions is between 3% and 20%, depending on the amount traded.

- Adjustment on the nominal growth of public sector expenditures, mainly by reducing economic subsidies to public tariffs.

- Maintenance of the bank reserve requirement rate between 93% and 73%.

- Increase the monetary policy interest rate from 40% to 60% nominal annual interest rate.

Year-on-year inflation moderated from 3867% in March 2021 to 114.1% in August 2022, and the average monthly increase in retail prices was reduced from 37% in 2020 to 19.5% in 2021 and to 12.74% between January and December 2022.

But the program collapsed in August of this past year.

To contain the official devaluation rate, and as it happens in Bolivia or Argentina, the Venezuelan Central Bank faced important costs in terms of international reserves (which it managed to strengthen through the liberalization of the exchange market in May 2019).

This process became increasingly unsustainable, and the authority had to allow progressively higher devaluation increases, thus eroding the basic nominal anchor of the stabilization program, which was the expectations channel.

By February 2023, the official devaluation rate on the commercial exchange rate established by the Central Bank of Venezuela climbed to 11% due a monthly inflation rate that practically doubled.

The appreciation of the real exchange rate no longer functions as an anchor for expectations precisely because the system is expected to become unsustainable, and a more violent devaluation will occur.

The exhaustion of the last stabilization attempt and the abandonment of the regime of administered devaluations and exchange rate appreciation could precipitate a new hyperinflationary outburst, even if the fiscal position of the public sector has improved.

With information from La Derecha Diario