Financial flows seem to be playing in favor of Argentina in terms of bonds and stocks.

Still, this situation has no correlation in the exchange market, where the demand for the US currency outstrips the supply.

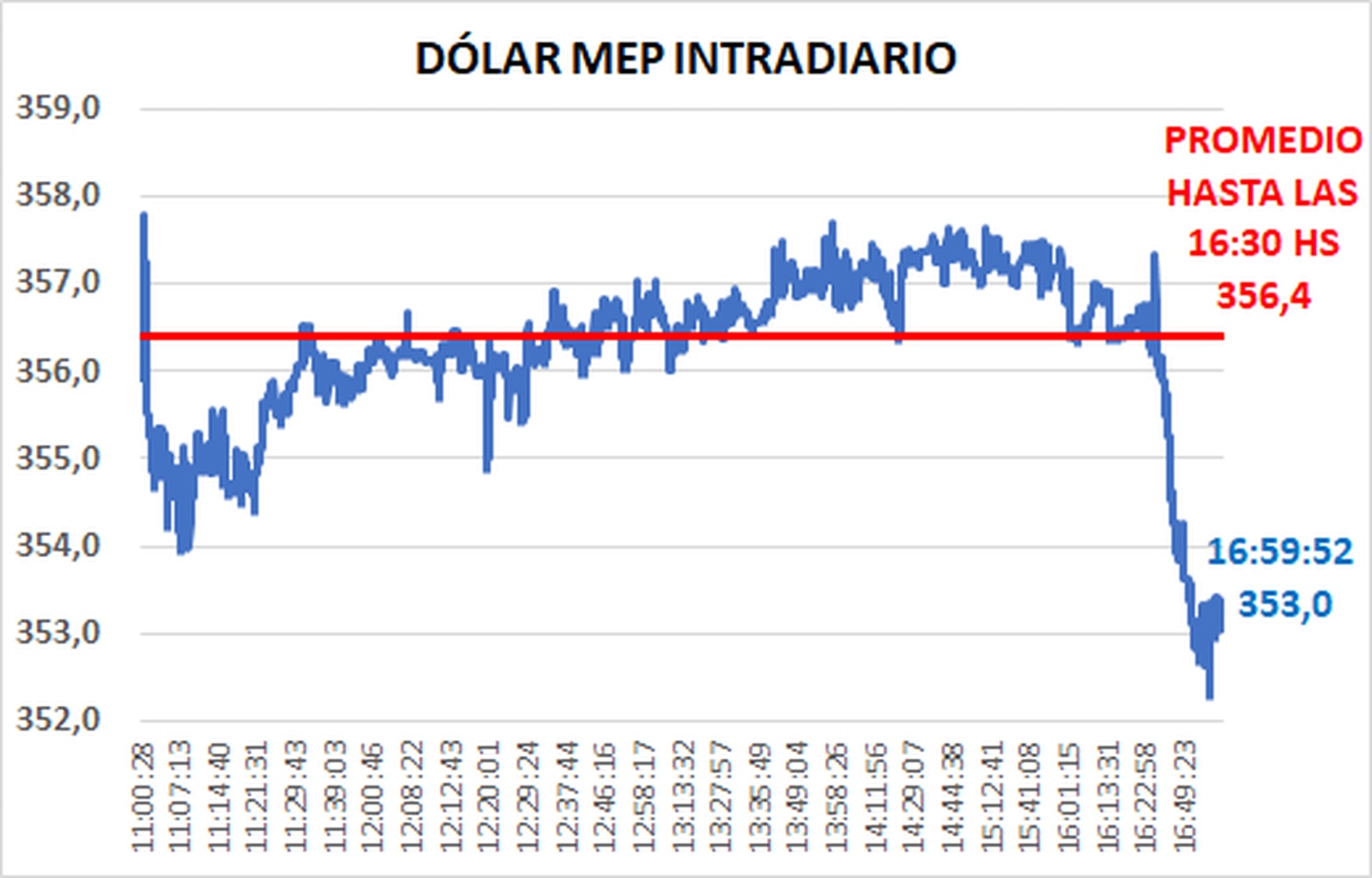

In this context, the MEP dollar and the dollar spot with liquidity (CCL) have been under strong upward pressure, contrary to the currencies of neighboring countries, where the US dollar is losing strength.

Furthermore, the Central Bank’s intervention in the fixed-income market partially cushioned the dollar’s soaring in Argentina.

So far this year, the MEP dollar, carried out with the GD30 bond, rose 7.6% (it costs $352.78), while the CCL did the same, 7.7% (it costs $370.58).

This scenario contrasts with what is seen in the main economies of the region, where local currencies have been winning the battle against the dollar.

WHAT IS HAPPENING WITH THE MAIN LATIN AMERICAN CURRENCIES

The currencies of the main economies in the region have been showing a trend of appreciation against the US dollar:

- In Brazil, the Brazilian real has appreciated 3.3% against the dollar this year.

- In Mexico, the local peso appreciated 3.8% against the dollar during January.

- The Colombian peso strengthened by 5.7% in the first part of 2023.

- The Chilean peso, meanwhile, rose 5.3% when compared to the dollar this year.

The Peruvian sol is an exception to this panorama. The dollar in Peru rose 0.6% (just over 3 cents of a sol).

However, it must be taken into account that the country is immersed in a wave of protests and violence following the impeachment of former president Pedro Castillo.

RISK ON, BUT NO IMPACT ON THE CURRENCY

Financial analyst and partner of Delphos Investment consulting firm, Leonardo Chialva, considered that this current regional mode of risk (perception of low risk in the market) should be looked at impacting Argentina, but not in the traditional way.

“The carry trade in local instruments does not seem to be the preference of foreign funds due to the doubts that exist in relation to the evolution of domestic debt in pesos,” said Chialva.

And he added: “If you look at 2022, you will find that there was carry trade in peso bills and bonds until that bubble burst in the middle of the year. The regional risk on mode left currency and carried trade aside to focus on stocks and hard dollar bonds. It is another way of taking exposure in high yield assets, but with less risk”.

Under this line of reasoning, Chialva considered that cash and cash equivalents did not move as the rest of the region due to the above.

Still, Argentine stocks and bonds outperformed other similar assets.

“Doubts about the potential solution of the peso debt led funds to avoid the classic carry in local currency in Argentina. They went for stocks and sovereign bonds in dollars”, he concluded.

MORE PESOS IN CIRCULATION

On the other hand, a report by the broker Aurum Valores stated that “the monetary expansion that raises the broad monetary aggregates is the main responsible for the adjustment reflected in the CCL dollar”.

The document details, “Our model correlating CCL with private M3 (monetary aggregate) in pesos indicates that current CCL prices are within what should normally be seen given the aggregate growth.”

The MEP dollar could be even higher if not for the interventions of the Central Bank of Argentina, which sells bonds against pesos and repurchases them against dollars to calm the situation.

With information from Bloomberg