The Brazilian Central Bank (BC) decided to maintain the basic interest rate, the Selic, at 13.75% per year this Wednesday (Oct. 26). The decision was unanimous and was expected by the financial market.

In September, the monetary authority interrupted a sequence of 12 consecutive interest rate hikes, the highest in the 21st century.

The rate has advanced 7.25 percentage points (p.p.) in 2021 and 4.5 p.p. this year, a total readjustment of 11.75 p.p. in the period.

On Wednesday (Oct. 26), the Copom (Monetary Policy Committee) opted not to change the level of the Selic for the second time in a row.

The monetary authority has signaled that the percentage should not change until mid-2023.

The Central Bank said in the statement that it will remain vigilant and will evaluate whether the strategy of maintaining the introductory rate for a sufficiently prolonged period will succeed in holding the convergence of inflation to the target.

“The Committee emphasizes that the future steps of monetary policy may be adjusted and will not hesitate to resume the adjustment cycle if the disinflation process does not go as expected,” wrote the collegiate.

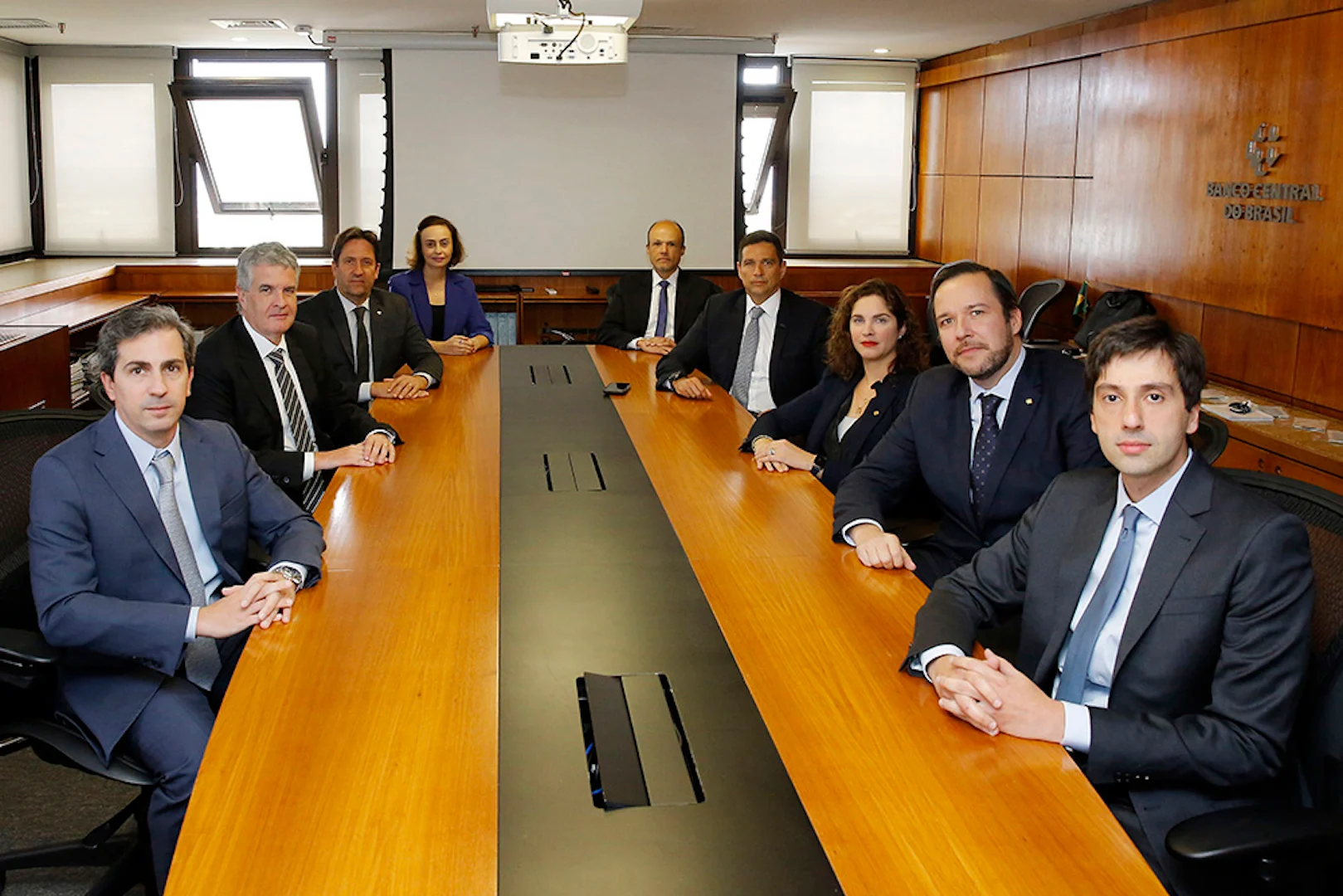

UNDERSTANDING COPOM

The committee is formed by the eight directors and the president of the Central Bank.

The 9-person composition of the team prevents a tie in monetary policy decisions. They meet every 45 days to set interest rates. The meetings last two days.

According to the schedule, the next meeting will occur on Dec. 6 and 7. Copom’s decision is made public on the second day of the session using a statement on the Central Bank’s website.

The meeting minutes are also published on the site up to 4 working days after the meeting date. That is, it will be released next Tuesday (Nov. 1).

When setting the Selic rate (Special System for Settlement and Custody), the Central Bank buys and sells federal government bonds to keep interest rates close to the value established at the meeting.

The Selic is the main instrument to control the country’s official inflation. The IPCA (National Consumer Price Index) has slowed down in the last three months.

The accumulated rate over 12 months cooled to 7.17% in September. It was 8.73% in August.

A large part of the rate reduction is due to the measure to limit the ICMS (state-level VAT on Sales and Services) rate on gasoline, electricity, and telecommunications.

President Jair Bolsonaro (PL, right) sanctioned the PEC (Proposal of Amendment to the Constitution) approved in Congress in June.

INFLATION TARGET

Even with the loss of steam, inflation is 3.67 percentage points above the inflation target of 3.5%.

The current level is also above the target ceiling of 5%.

If the year ends above this level, the president of the Central Bank, Roberto Campos Neto, will have to send a public letter explaining the reason for non-compliance.

According to the law that authorized the autonomy of the Central Bank, it is the foremost duty of the monetary authority to ensure the purchasing power of the population.

Campos Neto had already had to explain in 2021 when inflation reached 10.06%, and the target was 3.75%.

The president of the Central Bank justified that oil and energy put pressure on the price index. Read the full text here.

The most recent financial market projections, released in the Focus Bulletin, indicate that inflation will still slow down to 5.60% by the end of 2022.

It is still above the 2022 target ceiling of 5%. Analysts estimate that the Selic will end 2022 at 13.75% per year, the current level.

The high Selic also impacts the country’s economic activity because it makes credit more expensive.

The financial market projections indicate that the country’s GDP (Gross Domestic Product) will grow by 2.76% in 2022.

A RISE OF 11.75% SINCE 2021

The cycle of Selic readjustment started in March 2021, from 2% to 2.75%, and ended in August this year. The jump was 11.75 percentage points.

Remember:

March 2021 – from 2% to 2.75% (+0.75 p.p.);

May 2021 – from 2.75% to 3.5% (+0.75 p.p.);

June 2021 – from 3.5% to 4.25% (+0.75 p.p.);

August 2021 – from 4.25% to 5.25% (+1 p.p.);

September 2021 – from 5.25% to 6.25% (+1 p.p.);

October 2021 – from 6.25% to 7.75% (+1.5 p.p.);

December 2021 – from 7.75% to 9.25% (+1.5 p.p.);

February 2022 – from 9.25% to 10.75% (+1.5 p.p.);

March 2022 – from 10.75% to 11.75% (+1 p.p.);

May 2022 – from 11.75% to 12.75% (+1 p.p.);

June 2022 – from 12.75% to 13.25% (+0.5 p.p.);

August 2022 – from 13.25% to 13.75% (+0.5 p.p.);

Next, the Central Bank opted to maintain the Selic at the same level in two meetings:

September 2022 – stable at 13.75%;

October 2022 – steady at 13.75%.

The sequence of Selic hikes can be considered the highest in 23 years since the average interest rate in the economy rose from 29.21% per year in December 1998 to 44.96% in March 1999.

At that time, there was a floor and a ceiling for the base interest rate. In 1999 the inflation target system was created.

Before 2021, the Selic registered five consecutive years of low-interest rates.

It fell 12.25 percentage points in this period, from 14.25% to 2%.

With inflation pressured by the effects of the covid-19 pandemic and the war in Russia and Ukraine, the Central Bank raised interest rates by 11.75 percentage points in less than two years.

REAL INTEREST RATES AT 7.5%

Actual interest rates – corrected for inflation – should be 7.5% in the next 12 months. The projection is from Austin Rating’s chief economist, Alex Agostini.

From February 2021 to October 2022, the rate rose 13.8 percentage points.

The percentage is high because inflation is falling, and the BC (Central Bank) has signaled that it will maintain the introductory rate, the Selic, at 13.75% per year for an extended period.

The survey was based on the “ex-ante” projection, i.e., when the annualized interest rates are calculated based on the predictions for the next 12 months.

According to the estimate, interest rates were negative for 20 months, from March 2020 to October 2021. It reached its lowest level in February 2021, at -6.3%.

When considering the “ex-post” calculation, when the estimates for the 12 months before the reference month are considered, Brazil’s real interest rate was 5%. During the period, inflation was higher, and the Selic was on an upward trend.

In this calculation, interest rates were negative from October 2020 to July 2022, or 22 months.

The lowest peak was in September 2021, at -6.6%. It rose 11.6 percentage points to the current October level of 5%.

With information from Poder360