Next week’s elections in Brazil pose a challenge for investors in energy giant Petrobras.

Former President socialist Luiz Inácio Lula da Silva, who polls show is the favorite, has promised to use the company as a tool for the country’s development.

Current conservative President Jair Bolsonaro, who is seeking re-election, on the other hand, is proposing the exact opposite, privatizing the national colossus.

This difference is rare in this election period, where the two leading candidates have revealed little about their economic strategies.

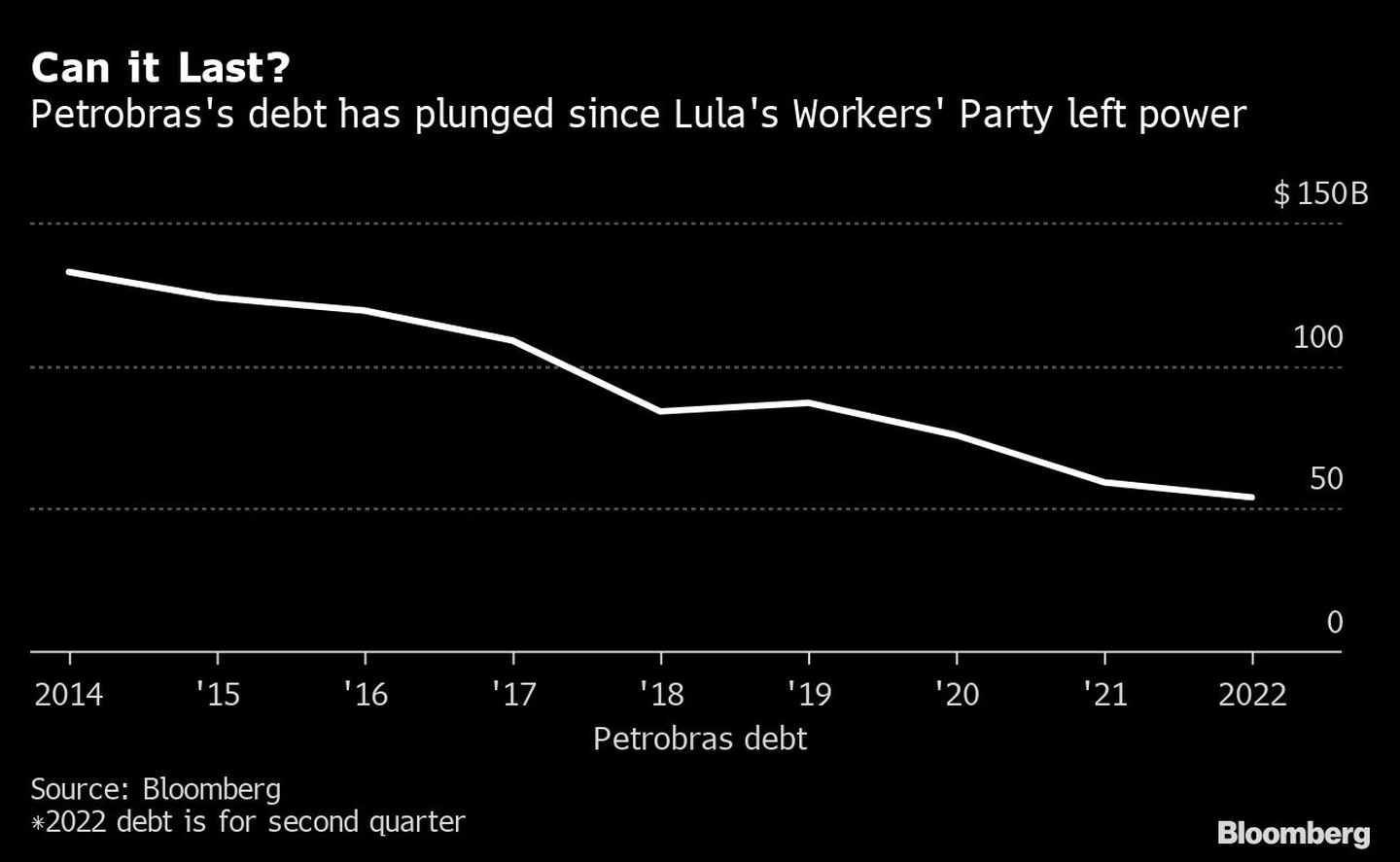

It also makes Petrobras a double-edged sword for investors: the company is generating profits and share prices are already low compared to other companies, but cash flow could dry up and debt could rise if Lula da Silva wins and sticks to his proposals.

“This is probably one of the most complex investment cases in the country,” Flavio Kac, portfolio manager at ASA Investments told Bloomberg.

“A Bolsonaro victory would pave the way for possible privatization, while a new government could lead to pressure on margins and lower profits.

This Friday, shares of Petrobras fell sharply after crude prices dipped below $80, the biggest drop in 2022.

Petróleo Brasileiro SA (Petrobras), Latin America’s largest oil and gas producer at 2.7 million barrels per day, became a bone of contention during the first presidential debate.

Bolsonaro accused Lula da Silva of mismanaging the company and presiding over an epic corruption scandal.

Lula da Silva criticized Bolsonaro for “splitting up” Petrobras through asset sales and deciding to privatize the utility Eletrobras.

Lula da Silva, a former labor leader who governed Brazil from 2003 to 2010, has a troubled past with Petrobras and the oil industry in general.

He oversaw the growing production and discovery of the largest group of deepwater fields this century, which have become a profit center for Petrobras.

At the same time, he halted new lease sales in the so-called pre-salt area to revise taxes and regulations, which accelerated the growth of oil production.

Analysts say that without the licensing delays, Brazil would be pumping twice as much now.

Lula da Silva also introduced costly construction requirements in Brazil that discouraged investment.

If he wins the election, the local oil industry will be watching who he recruits to his energy team to gauge how big the political shift will be.

“Lula da Silva relied heavily on his lieutenants, so who is this new gang?” said Schreiner Parker, head of the Latin America division of consulting firm Rystad Energy.

“It will be interesting to see who will fill the top positions.

Political consulting firm Eurasia estimates Lula da Silva’s chances of winning the election at 70 percent.

Another Lula da Silva administration would push Petrobras to expand its refineries in Brazil and rebuild its international operations, Senator Jean Paul Prates, its oil and gas contact, said in an interview.

The company would also become a global player in the energy transition, even if it means lower profits and dividends.

Petrobras’ narrow focus on the pre-salt project has made a lot of money in the short term, but the company remains exposed to a changing industry for decades to come, he said.

“It’s become a huge cash cow, and it’s not going to stay that way,” Prates said. “It’s like falling off a cliff blindfolded.”

Lula’s da Silva Petrobras would seek an energy transition and expand its refinery.

While Lula da Silva enjoyed a massive boom during his eight years in office, helped by a commodities super-cycle, his legacy was tarnished by policy mistakes made by his successor and the so-called Lava Jato corruption investigation.

The investigation focused on Petrobras and kept him in jail for nearly a year and a half.

His conviction was later overturned by the Supreme Court on procedural grounds, but many Brazilians still see him as a symbol of corruption.

In the first presidential debate, Bolsonaro called the Lula da Silva government “the most corrupt in history.”

EXPLORING

Regardless of the outcome of the October elections, Brazil will certainly not stop oil production.

Both candidates support oil and natural resource exploration, unlike Colombia’s newly elected President Gustavo Petro, who wants to ban new exploration due to environmental concerns.

Moreover, Petrobras has found so much oil this century that production will continue to rise no matter who wins.

“Petrobras will remain a giant in Brazil,” said Luiz Felipe Coutinho, CEO of Origem Energia, which bought onshore natural gas fields from Petrobras and considers the company its most important business partner.

Another issue that is unlikely to change regardless of the outcome is the risk that Petrobras will subsidize fuels.

Lula da Silva has attacked Bolsonaro over high gasoline prices, one of the main complaints of Brazilians this year.

Bolsonaro responded by attacking Petrobras’ board and eventually cutting taxes to ease the burden on consumers.

Lula da Silva’s victory may be stressful for Petrobras, but not catastrophic.

“At the end of the day, it’s not really a private company. There is another group of investors who understand the quasi-governmental aspect,” said Wilbur Matthews, founder of Vaquero Global Investment LP, who has held Petrobras bonds in the past but believes they are currently overvalued.

“You don’t buy Petrobras stocks or bonds because you love the corporate dynamic.”