Argentine inflation rose 7.4% in July. This is according to data released Thursday (11) by the Argentine Institute of Statistics and Census (Indec). This was the highest increase in 20 years.

As a result, Argentina’s central bank raised the country’s interest rate by 9.5 percentage points, from 60% to 69.50% per year. Read the central bank’s statement (102 KB).

The measure attempts to control inflation and stabilize the foreign exchange market. This is the 8th readjustment this year.

(Protests in Buenos Aires today)

Food prices increased by about 6% this month. Other areas have also seen an increase: Leisure and Culture (13.2%), Home Appliances and Maintenance (10.3%), Restaurants and Hotels (9.8%), and Clothing and Footwear (8.5%).

According to La Nacion, President Alberto Fernández expressed concern about the rising prices. The highest CPI (consumer price index) in 2022 was reached in March at 6.7 percent.

Also, in March 2022, Argentina agreed with the IMF (International Monetary Fund) to restructure its US$44 billion debt. Among other things, the country pledged to keep the interest rate at a positive real percentage to attract investment in public bonds.

The IMF said there were “exceptionally high risks” of non-compliance with the economic program in March. The financing was intended to support Argentina’s balance of payments and budget.

It would require establishing debt sustainability, fighting high inflation, increasing financial reserves, and promoting growth. It will not be paid until 2026 and will run until 2034.

To comply with the agreement, the government must reduce the primary deficit – revenues minus expenditures, excluding debt interest payments – from 3% in 2021 to 2.5% in 2022. By 2024, it should reach 0.9% of GDP (gross domestic product).

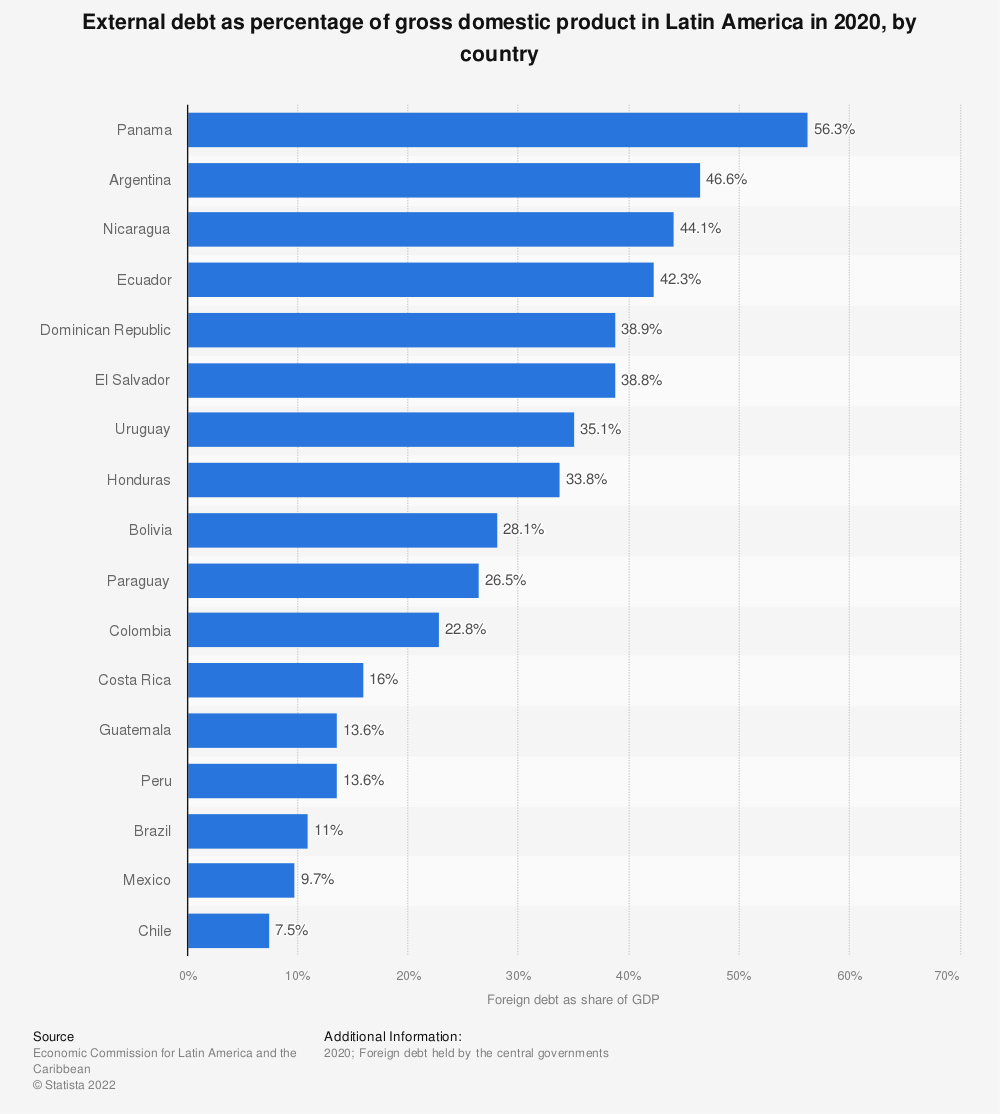

According to the Ministry of Economy, Argentina’s gross debt was 80.1% of GDP (gross domestic product) in the first quarter of 2022. Brazil has a similar ratio, 78.5% of GDP.

What worries Argentina, however, is the fact that 55.5% of its debt is denominated in foreign currencies; in Brazil, it is much less. International reserves are also low, at US$39.5 billion, while Brazil currently has US$378.4 billion in international reserves.

The country’s currency has weakened against the real, which has also depreciated against the dollar in recent years. Eating meat in Argentina, for example, can cost half the price compared in Brazil.

Silvina Batakis took over the country’s Ministry of Economy after Martín Guzmán resigned. But 24 days later, Argentine President Alberto Fernández appointed Sergio Massa as his successor.

The country’s government is also undergoing political upheaval. Alberto Fernández and Cristina Kirchner are not only under pressure from the street but also publicly disagree on how to solve the country’s economic problems.

Kirchner advocates more significant economic intervention to mitigate the effects of the crisis on low-income segments of the population. Fernández disagrees.

The economic situation has prompted the population to protest, as have producers in rural areas, who are also struggling with diesel shortages and problems in Argentina’s supply chains.