Argentina is experiencing a severe exchange rate crisis that has brought back memories of previous economic debacles in a country that seems to be always in financial instability.

Amid a context of political tensions, the devaluation of the Argentine peso against the dollar in the informal market has skyrocketed, and the consequences of the economic weakness and the management of the foreign debt are reflected in aspects such as very high inflation, fiscal imbalance, higher country risk -about investment- and production.

ARGENTINE PESO (ARS) DEVALUATION

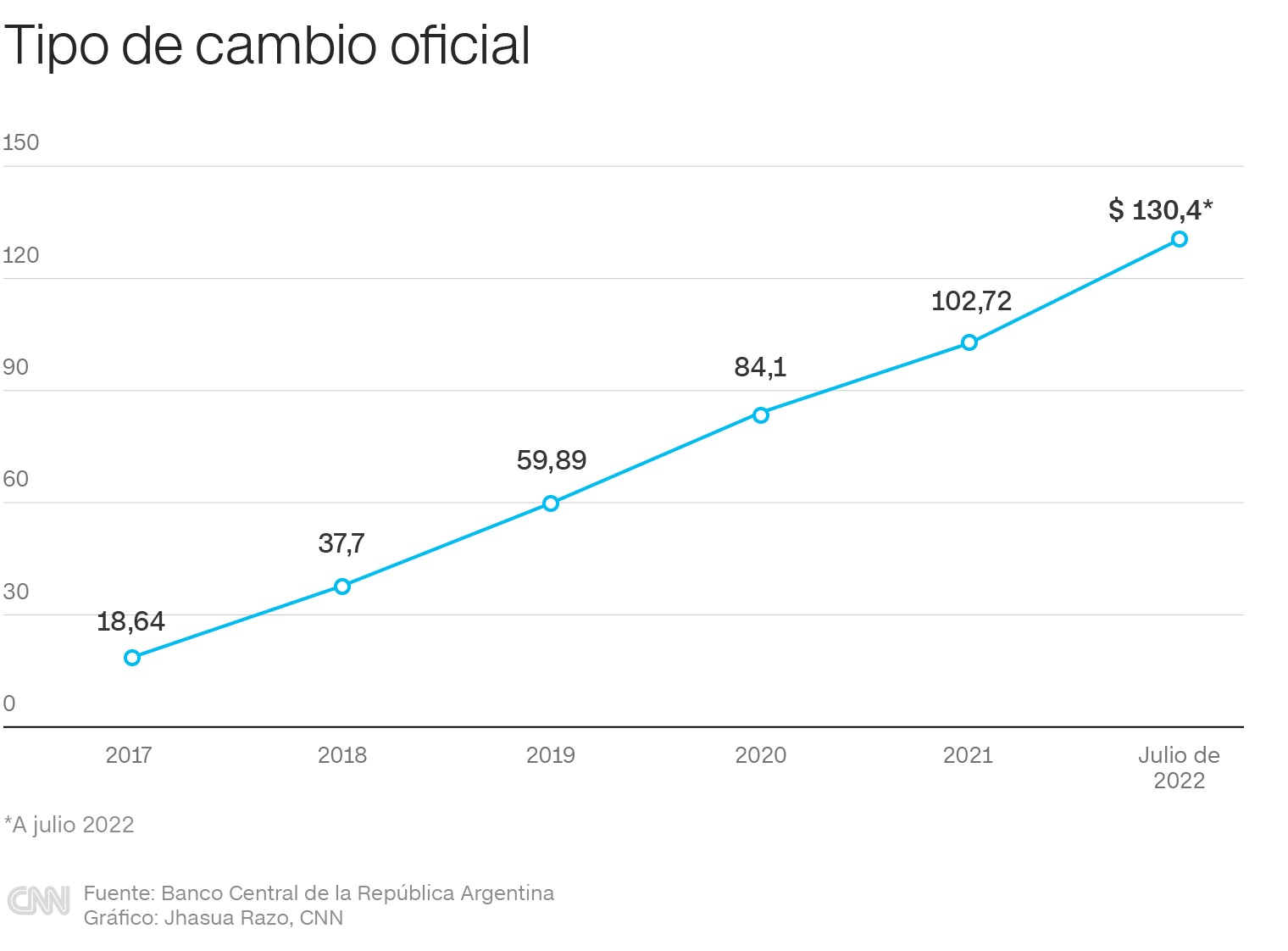

The disparity between the official and blue (informal) exchange rates has accelerated in the last month. Market data show that on July 1, the parallel exchange rate was ARS 239.

After a chaotic weekend due to the resignation of Martín Guzmán to the Ministry of Economy, on Monday, July 4, the blue dollar reached ARS 260 for the first time, after several oscillations below that figure, already with Silvina Batakis as the new Minister of Economy. A week later, it surpassed ARS 270.

Today, the blue dollar is around ARS 326, and the official dollar is ARS 130.

The dollar in Argentina is divided into different quotes, depending on the type of market and consumer. That is to say, the same greenback can be worth at least 150% more, depending on the nature of the transaction.

In the informal market, there can be as many quotes as transactions between private parties since, given the exchange rate distortion, people often agree on an exchange rate that suits them for negotiation. But in general, there are these variants of the dollar:

- Official dollar (retail)

- Official dollar (wholesale)

- Informal dollar (or blue dollar)

- Savings or solidarity dollar

- Tourist dollar

- Stock exchange or MEP dollar

- Cash with liquidation dollar

Due to the exchange restrictions and the limits to the amount of dollars that people can acquire in the official market, Argentine citizens who want to obtain greenbacks turn to the black market, where the quotation in these circumstances is less advantageous than the official one (the dollar is more expensive), but there are no restrictions.

David Miazzo, the chief economist of Fundación Agropecuaria para el Desarrollo de Argentina (FADA), said on CNN Radio that “everything starts with a great fiscal imbalance, which turns into a monetary imbalance due to the printing to finance the deficit.”

And then, it is transferred to an exchange imbalance because the government’s objective is to maintain the official dollar as an exchange and nominal anchor. And all this generates a deep backwardation of the official exchange rate.

Today, ARS 130 seems an artificial value because people and companies are willing to flee from the peso at ARS 330″.

SKYROCKETING INFLATION

Reducing inflation to a more stable level must be the Argentine government’s top priority, said on Tuesday the director of the International Monetary Fund’s Research Department, Pierre-Olivier Gourinchas, who defined Argentina’s situation as very worrying.

The deputy director of the Research Department added that while the 4% annual growth projection remains unchanged for now, the growing risks make it necessary to talk before the second review of the agreement already agreed for refinancing the debt.

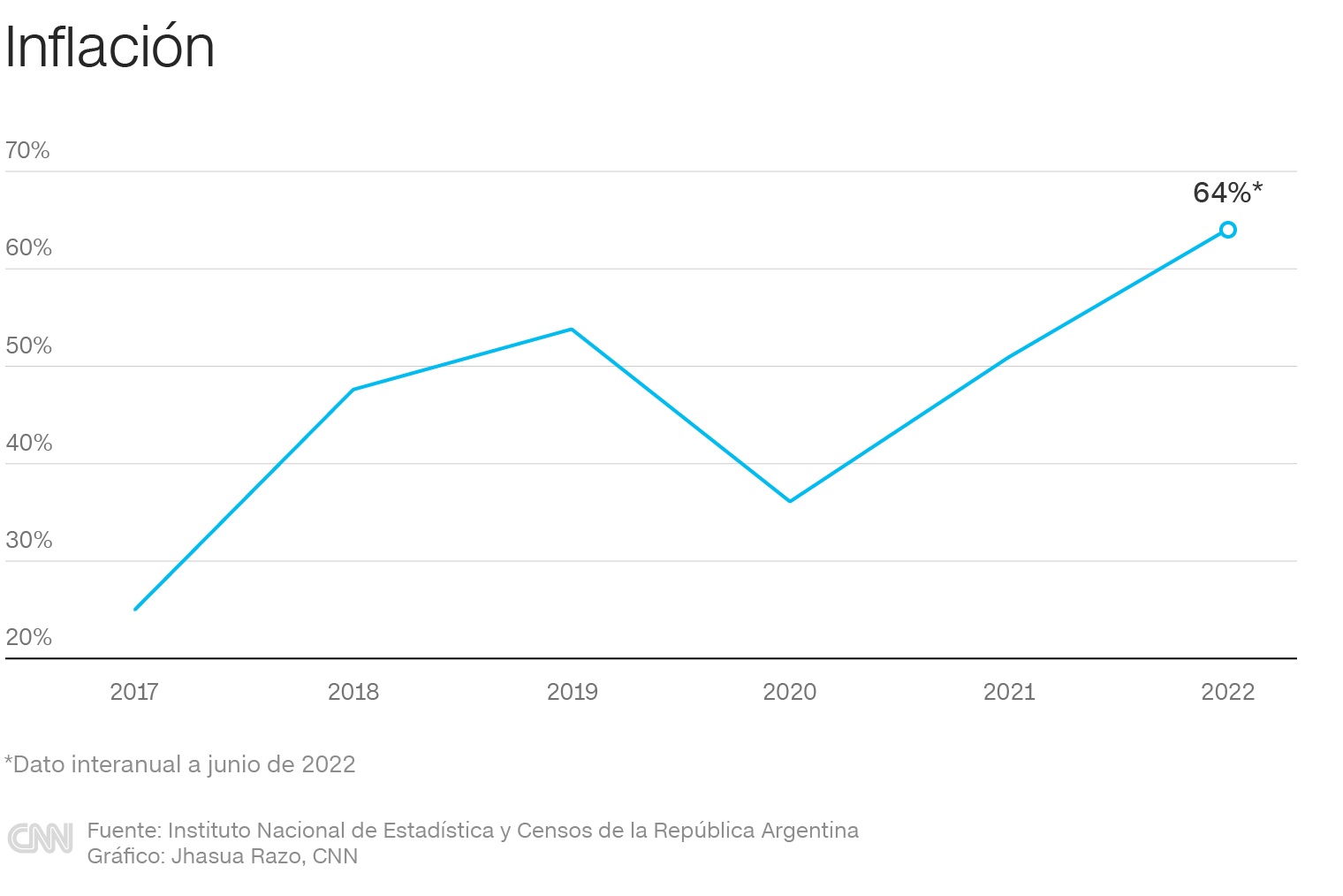

Whatever the economic growth this year, it will occur amid an escalation of prices that has afflicted the country for at least a decade: In June, the National Institute of Statistics and Census of Argentina (Indec) reported a year-on-year inflation rate of 64% and 36.2% so far this year. According to the Argentine Central Bank’s (BCRA) monthly survey, it is expected to reach 76% this year.

INFLATION UNDER EACH OF THE RECENT GOVERNMENTS

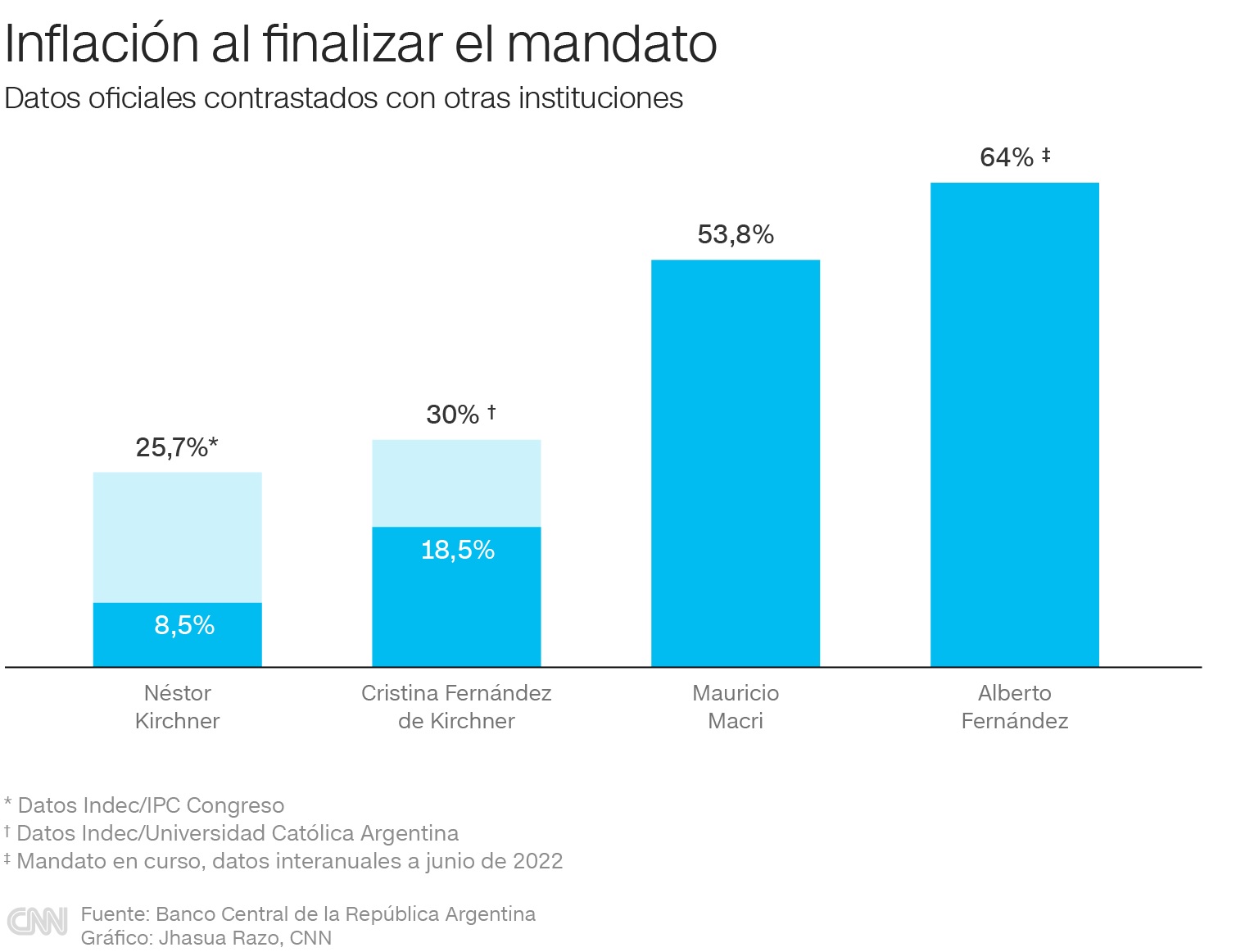

After the intervention of Indec in 2007, statistical data began to lose credibility, and the use of alternative sources to refer to inflation values, which some considered undervalued, and poverty, which the agency stopped publishing in 2013, grew. The Indec was later reformed during the government of Mauricio Macri and regained its credibility.

The collated data show how inflation has skyrocketed since Néstor Kirchner’s government in 2007: from 25.7% to 30% at the end of Cristina Fernández de Kirchner’s term in 2015 and 53.8% when Macri handed over power in 2019.

Economist Luis Secco told CNN Radio that the chances of Argentina meeting the conditions of the new agreement with the IMF “are reduced”.

“Today, inflation shows that nothing has changed in the Argentine economy. If everything written in the letter of intent (with the IMF) is fulfilled, there should be another additional tariff increase, but I think the winter is going to be very hard, and fuel prices are going to go up; therefore, you are going to have renewed inflationary pressures”.

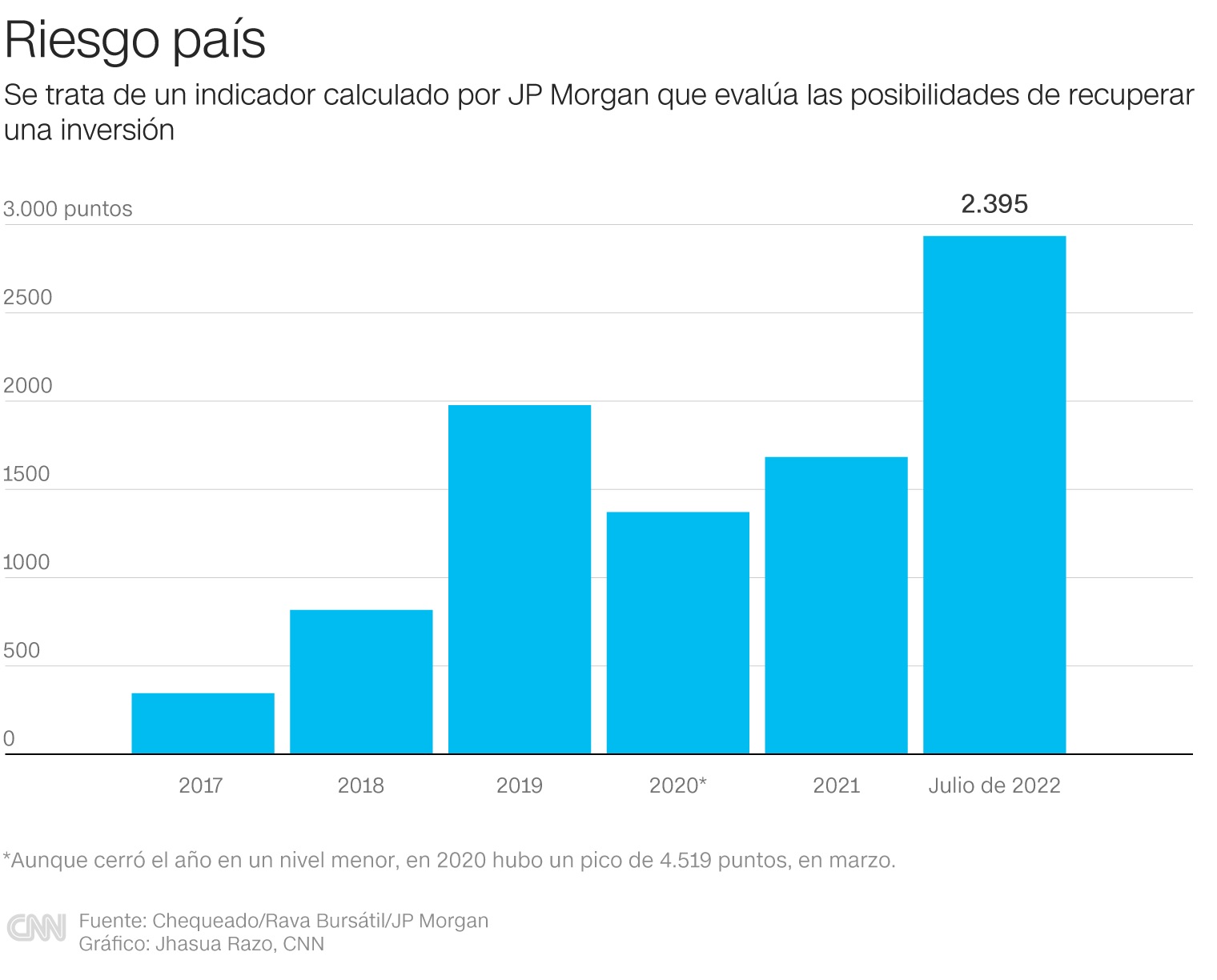

THE POSSIBILITIES OF RECOVERING THE INVESTMENT

With the peso’s devaluation, the country risk, an indicator calculated by JP Morgan that evaluates the possibilities of recovering an investment, reached 2,935 points last week, according to Reuters, the highest level since the 2020 bond exchange. In comparison, Uruguay’s country risk indicator is 136 points, and Chile’s is 169.

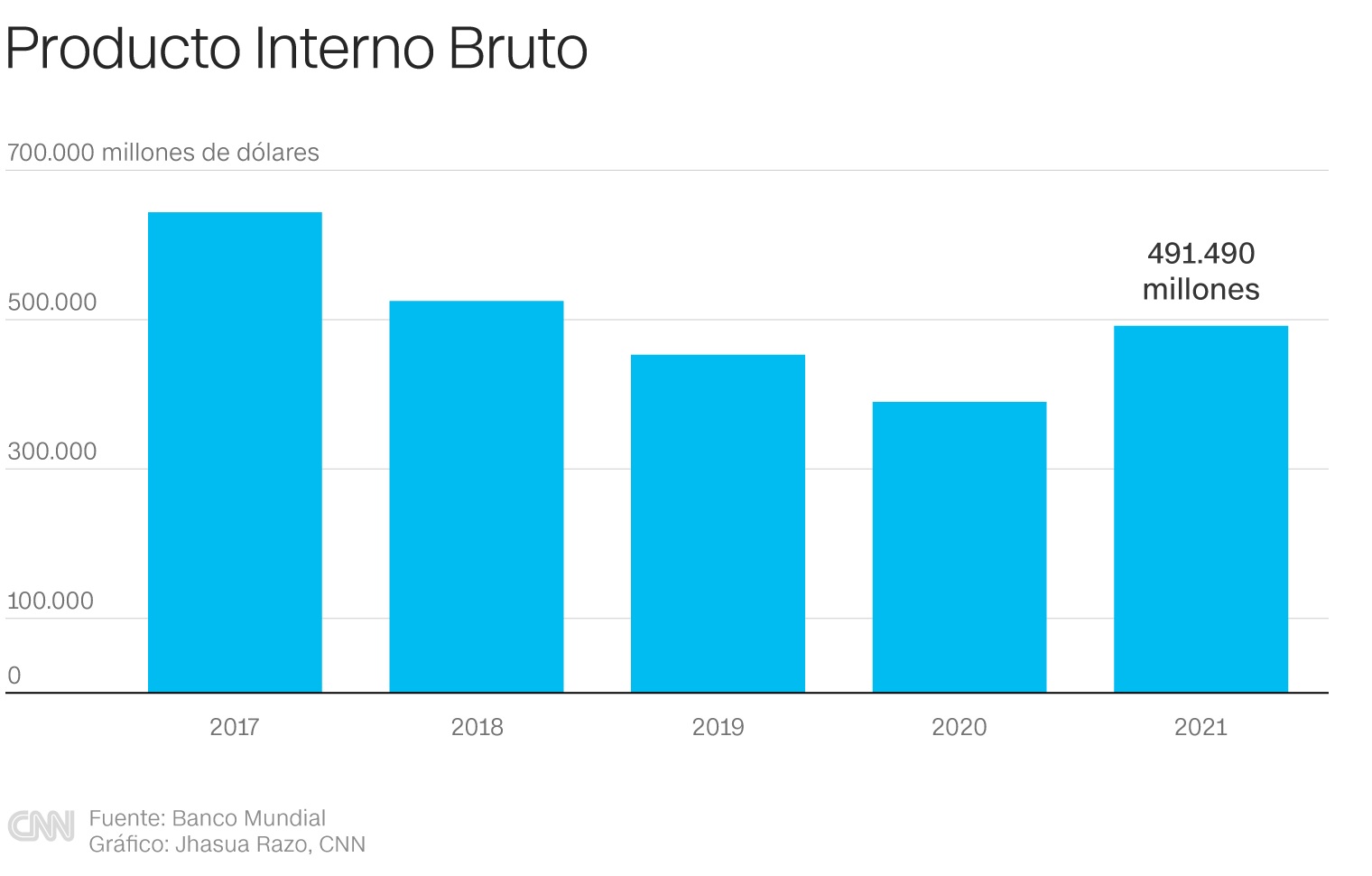

GDP

When current President Alberto Fernandez took office, the economic situation was already bad: after falling 2.6% in 2018, that year GDP contracted by 2% again before Fernandez’s inauguration in December.

Argentina’s economy grew by 10.3% in 2021, but only as a rebound after the 9.9% slump recorded in 2020 due to the covid-19 pandemic, and in the first quarter of 2022, Gross Domestic Product grew by 6% year-on-year and by 1.5% over the previous quarter, according to Indec.

With information from CNN