RIO DE JANEIRO, BRAZIL – Brazilian steel mills see trade disruptions caused by the war in Ukraine as a reason for the United States to lift restrictions on its steel imports.

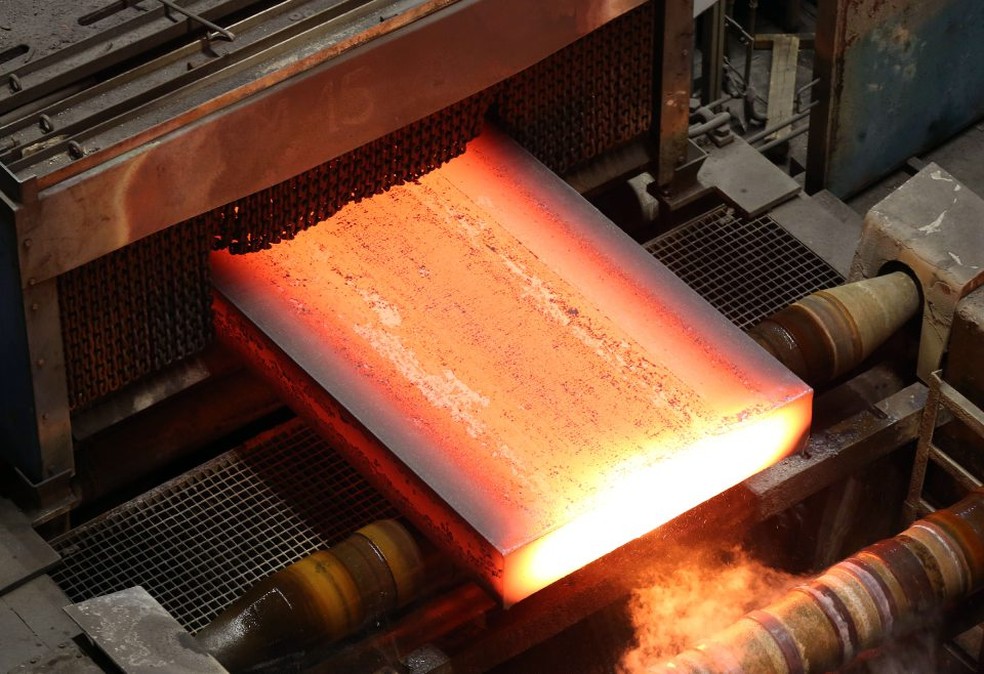

The Brazilian steel industry is calling on the State Department to seek the resumption of talks with U.S. authorities to lift the so-called Section 232 measures, which limit shipments of semi-finished products, mainly slabs, to 3.5 million tons per year, said Marcos Faraco, president of industry association Instituto Aço Brasil.

Last month, Japan reached an agreement that will allow most of its steel shipments to enter the U.S. duty-free.

With the U.S. importing more than a million tons of Russian slabs, rising geopolitical tensions are in favor of Brazil, the ninth-largest steel-producing country.

The lifting of the quota system introduced by former President Donald Trump in 2018 would be a welcome move for Brazilian steelmakers, which are struggling with rising costs as the war continues to tighten energy and coal markets.

“At this point, these discussions are much more important,” Faraco said in an interview. “The U.S. is starting to have that demand, and Brazil can meet the demand.”

Brazilian steelmakers are trying to source coal from the U.S., Canada, and Australia to replace supplies from Russia and Ukraine. Time is of the essence, as the industry has 120 to 150 days’ worth of stockpiles, Faraco said.

Rising coal prices support Aco Brasil’s plan to produce more steel from scrap, which produces about 90% fewer greenhouse gases than metal made from iron ore and coal. Brazil is not self-sufficient, but exports 10-15% of its ferrous scrap.

The Brazilian association is discussing with authorities measures to promote the use of scrap, such as a fleet renewal program that provides incentives to phase out old vehicles and use recycled materials to produce new vehicles with a lower carbon footprint.

The industry is also focusing on greater energy efficiency and a shift to renewable energy to reduce emissions by 2030 when new technologies are expected to be available for cleaner steel production.

With information from Bloomberg