RIO DE JANEIRO, BRAZIL – Estimating how much coffee Brazil will supply is difficult for even the most experienced meteorologists after a prolonged drought, multiple touches of frost, and now flooding damaged plantations in the world’s largest producer.

Few harvests are tracked as closely as Brazil’s coffee crop, which accounts for more than 45% of the world’s production of Arabica beans, prized by high-end roasters for their milder flavor.

Traders are watching every estimate from analysts who travel the country visiting farms to examine the health of their plantations. But this year, many forecasters who might usually see, smell, taste, and feel the beans firsthand rely on second-hand figures or extrapolating from weather and past trends.

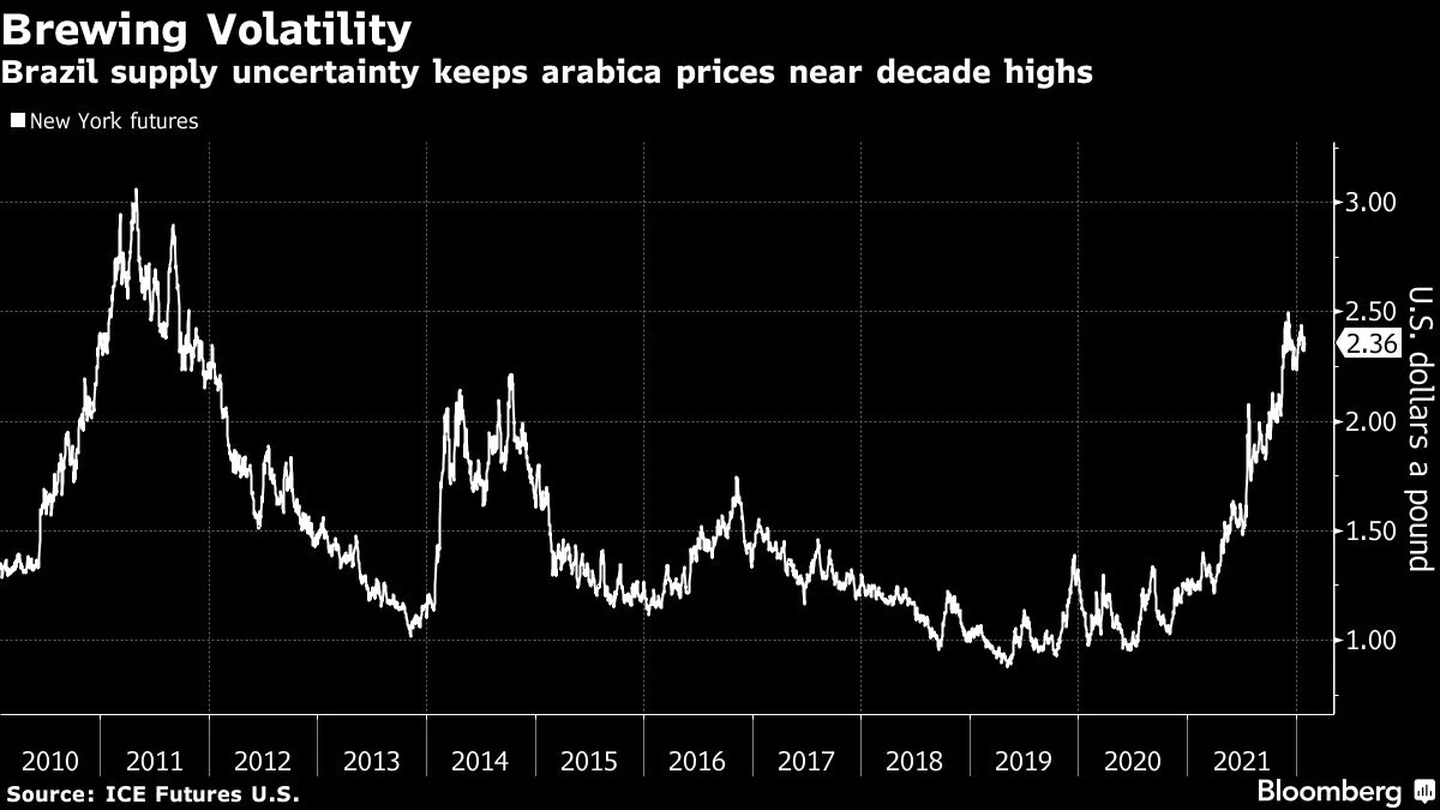

This year’s crop is critical, as it is the largest in a two-year cycle for arabicas and follows last year’s dismal crop, which sent futures prices soaring to decade highs. A wide range of estimates and large swings only increase price swings in a market known for its volatility.

While drought was the problem last year, downpours pose a new threat. Parts of the states of Paraná and São Paulo will experience flooding in the coming days, increasing the threat to crops, analysts say.

It has kept future prices near the decade highs reached in December.

“Assessing the crop is more difficult than ever,” said Hernando de la Roche, senior vice president at StoneX Financial Inc. in Miami. “And for farmers and those who will be inspecting fields, the upcoming flooding won’t help.”

Analysts have been frustrated by the pandemic, which has made it more difficult and dangerous to move around the country. StoneX and Rabobank are scheduling trips to reassess fields and crops in the coming weeks.

The U.S. Department of Agriculture attaché did not conduct the usual annual field trips, citing Covid-19 and social distancing protocols. The agency said its widely followed figures were based on historical data, observed weather patterns, and crop figures from other sources.

Brazil could produce 61.4 million bags of arabica and the harder robusta beans in the 2022-2023 season, according to the average of nine analyst estimates compiled by Bloomberg. While that figure is up from 52.8 million last year, it is down from 65.2 million bags in the previous high-yielding cycle in 2020-21.

That midpoint covers a wide range of 53 million to 66 million 60-kilogram bags. For Arabicas, it is even wider, from 31 million to 46 million, a larger gap than the annual production of Colombia, the second-largest Arabica shipper.

Forecasts are often a moving target. In March, Volcafe, the coffee unit of ED&F Man, estimated the 2022-23 arabica crop at 53 million bags before extreme weather hurt the outlook. After more field visits yielded new evidence of damage, the company cut its outlook fivefold to 37.5 million bags in a recent report.

Even for the cheaper robusta crop, the forecast for a record crop is not set in stone, as plants are also showing stress, said Judy Ganes, president of J. Ganes Consulting, who traveled to the country several times. “People are too optimistic. The problems are bigger than they think.”

Farms in the same regions, or even plots within the same farm, show different flower development, which will lead to varying numbers of beans on the trees, clouding the production forecast, said Jorge Cuevas, head of coffee for Sustainable Harvest, an importer in Oregon. “Clarity will emerge around April and May, once the coffee hits the mills,” he said.

“Forecasting Brazil’s 2022 crop has become an exercise in futility.”

With information from Bloomberg