RIO DE JANEIRO, BRAZIL – The “Asian invasion” in the dispute for Internet sales in the country is starting to change the power game among the giants of e-commerce. A survey conducted by Bank of America Merrill Lynch (BofA) placed Shopee as the favorite of Brazilian consumers.

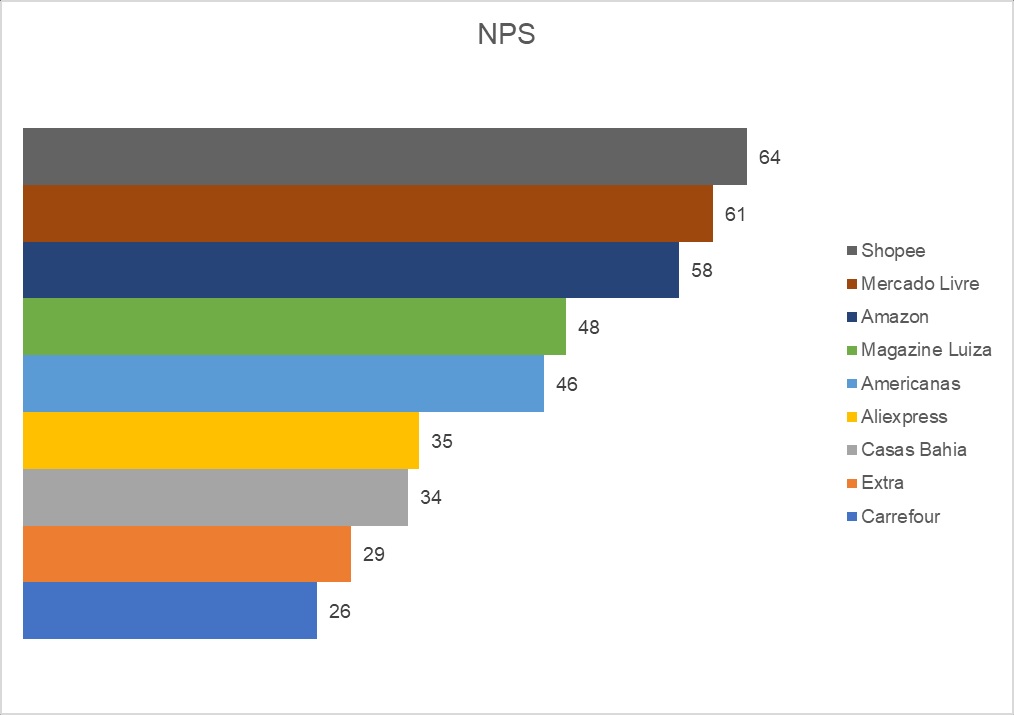

The Singaporean company overtook Mercado Livre (MELI34) in customer satisfaction, measured by the NPS (Net Promoter Score).

Shopee now leads the segment in this metric in four of the country’s five regions, tying with Mercado Livre only in the southeast region. The company’s NPS score rose from 60 to 64 compared to the last survey in September.

In addition, Shopee increased its price leadership and continues to lead the market in number of active app users, with 43.6 million.

BofA also draws attention to the opening of the company’s first distribution center in São Paulo, which may decrease delivery times since most of the platform’s sellers are in Brazil.

Mercado Livre is not the only one that has reasons to worry about the competitor from outside. Magazine Luiza showed a worsening in consumer perception, and Via – owner of Casas Bahia and Ponto Frio – remained with bad indicators, according to the BofA survey.

Check out the customer satisfaction ranking of the e-commerce giants below:

THE SHOPEE PHENOMENON

Shopee’s growth has been driven by Brazilian sellers, responsible for most of the sales made within the platform. Also drawing attention is the addition of Shopee to Nubank Shopping, announced earlier this year – at the time, the digital bank gave a R$10 (US$1.80) coupon to its customers to buy on Shopee.

Even so, the company is being watched more closely by consumer protection agencies: Shopee recently agreed with Procon-SP to ban the sale of counterfeit and smuggled items and commit to only selling products with tax invoices and guarantee immediate reimbursement in case of late delivery.

The pressure also comes from the competition, which has demanded more rigor from the government to collect taxes and fees on products that cross the borders.

A study prepared by the Institute for Retail Development (IDV) in partnership with McKinsey estimated that the country failed to collect between R$37 billion and R$48 billion in taxes from e-commerce, of which R$19 billion to R$20 billion would be due to cross-border transactions.

E-COMMERCE HAS ROOM TO ADVANCE

The Bank of America research that informed the report’s publication also broadly looked at the e-commerce landscape.

While the pace of growth in internet spending has slowed, it is still much higher than the pace of retail in general – e-commerce has grown 38.6% since 2019, compared to an 8.8% advance in physical stores.

Survey participants reported improved product availability and service provided by online stores since the pandemic began.

Although some consumers still favor physical stores, especially when shopping for clothes, the vast majority said they have no intention of abandoning e-commerce once the health crisis is over.

Also, according to the report, fewer people intend to buy online in the following months. Except for furniture and household items, appliances, and books, all sectors registered fewer potential buyers.

BofA attributed this result to the end of the bailout, rising inflation, higher interest rates, and increasing unemployment, putting pressure on household budgets. The resumption of face-to-face events also decreases disposable income for internet spending.