RIO DE JANEIRO, BRAZIL – Mexican auto insurer Crabi closed a US$4 million seed round led by Kaszek Capital.

Tuesday Capital, a San Francisco venture capital firm that also invested in Uber and Airbnb, and Redwood Ventures, which focuses its investments in Latin American companies, also participated in the round.

There are over 50 million cars in Mexico and only 30% of them are insured, compared to 50% in the rest of Latin America, the company said.

Unlike other startups in the sector, Crabi is licensed by Mexico’s National Insurance and Guarantees Commission (CNSF), which allows it to market and underwrite insurance, which means it can shortcut the whole process of obtaining insurance.

“Crabi is the first startup in Mexico to be licensed as a full-stack, full-risk auto insurer,” said Crabi’s founder and CEO Javier Orozco.

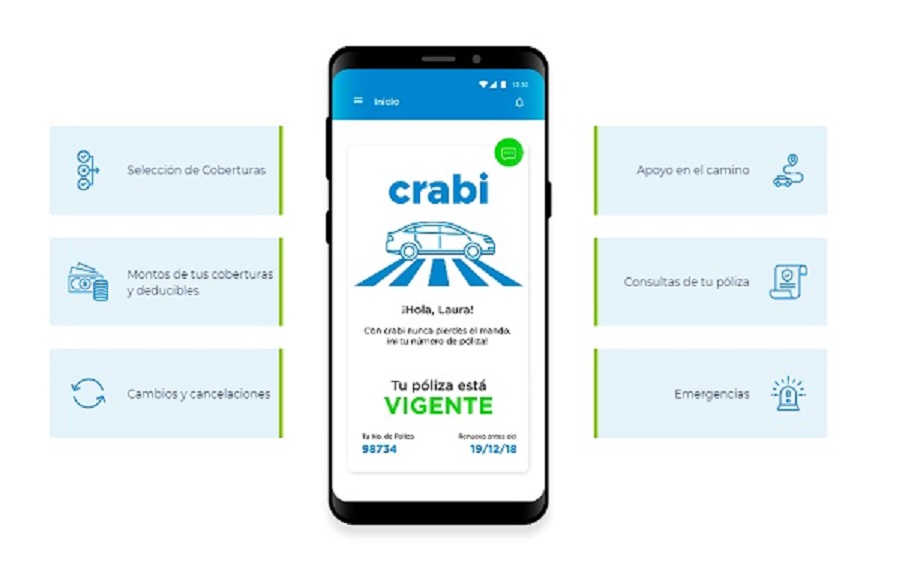

Until now, Crabi marketed insurance, but the final consolidation was handled by a third party. Users can access Crabi’s website or download its app and apply for insurance in 5 minutes, the company said.

With its new license and US$4 million in the bank, Crabi plans to shortcut the whole process and further develop its operations.

“We plan to eliminate the relationship with regulators and users. Insurers have a relationship with regulators, but not with users. Startups like Guros have users, but no relationship with regulators,” Orozco said. Guros is an online auto insurance marketplace in Mexico that raised US$5.8 million earlier this year.

In practice, Crabi’s plan is to design and maintain the policy, which allows the company to simplify, personalize and optimize the insurance contracting process. The company currently has 13,000 users, 60 employees and an annual growth rate of 110% (so far in 2021).

“There is plenty of room for innovation in the Mexican auto insurance market, and Crabi is the only startup that offers a full-stack insurance product that is fully owned and operated by the company. We are proud to lead this round and excited to support Crabi’s innovation in this core market with its honest, fair and personalized auto insurance,” said Kaszek Ventures’ Nicolas Berman.

The company was founded in 2017 in Guadalajara and now operates nationwide. It took about two and a half years to secure a license from the CNSF. To support itself so far, the company has received US$1.4 million from angel investors and another US$3 million from Orozco.

HISTORY

Orozco has launched 5 companies and had two successful IPOs, which gave him the experience to launch Crabi.

“In Crabi’s initial stage, I needed to inject my own money first, as we needed to prove our concept and make sure everything worked,” Orozco said. Few investors would agree to a two-and-a-half-year launch period if they had invested in the startup.

Before founding Crabi, Orozco founded and sold a company called Weisser Technologies, which manufactured replacement parts for the TV industry, and another called International Gold Club, which produced software and hardware for slot machines. He then spent a year in Silicon Valley analyzing different business models and sectors.

“The problems were in front of me all the time, but I never saw them,” he said of his eye-opening experience.

He returned to Mexico with a “startup mentality” – building a simple startup with rapid growth potential – and knew he needed to find a market niche and a team aligned with his ambitions and methodology.