RIO DE JANEIRO, BRAZIL – Historically, this sort of thing was actually reserved for times of war. If governments were no longer able to finance their spending on the market, they would force the central bank into printing money for them.

As hyperinflation was the most frequent outcome, public monetary financing has since been officially taboo.

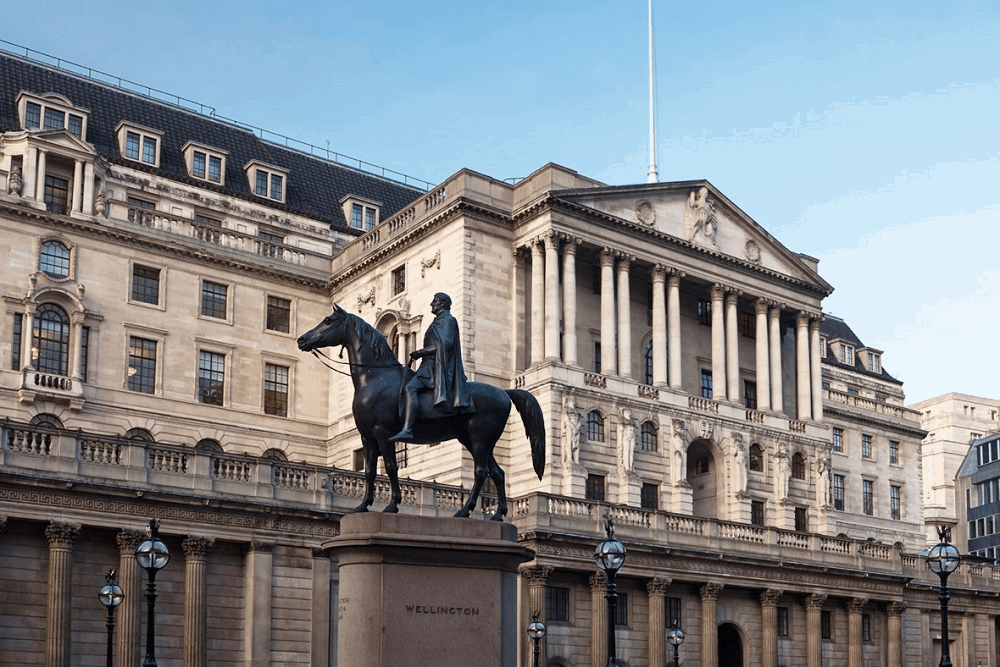

However, shortly before Easter, the British central bank unexpectedly announced that it would grant the government the option of withdrawing funds in any amount from its own bank. In doing so, it intends to ensure the functioning of the markets.

The Bank of England stresses that the overdraft facility must be fully repaid at some point. The fact is, however, that for the first time in this crisis, a Western central bank appears to have broken the taboo of direct state financing.

Unfortunately, this step does not come as a complete surprise. In response to the coronavirus crisis, most Western countries have pledged comprehensive state aid.

The sums to be spent amount to a fifth of annual economic output and beyond. Concurrently, the crisis will foreseeably lead to states collecting less taxes and levies. And unfortunately, many of these countries have plunged into the crisis already heavily in debt.

Consequently, in many cases the situation has now reached a point where such high additional expenditure as pledged in the fight against the virus can only be financed on the market at noticeably higher interest rates. However, since this would drive over-indebted states into insolvency even further, it is feared that resorting to the money-printing press will become increasingly acceptable.

In fact, the Bank of England’s taboo breach is only slightly more obvious than what is already happening in many other places, in a more covert way.

In a cloak-and-dagger operation, the European Central Bank launched what it claims is a temporary pandemic emergency plan as early as mid-March, in which it plans to purchase government bonds to the tune of up to €750 billion until the end of the year.

In Japan, which is heavily in debt, the central bank has long been pursuing this policy, and in the USA, the Fed also seems to have lost all shame. Although the purchase of bonds already on the market is only indirectly financed by governments and has traditionally been a legitimate means of monetary policy, it is still a very difficult task.

However, to this extent they are becoming more and more the actual source of funding for excessive government spending.

Low yields – danger of inflation

The only question is how this will affect the economy and investors. First, it is likely that nominal interest rates will continue to be kept artificially low by the monetary watchdogs for some time to come, which will not adequately reward savers for their risk (keyword “financial repression”).

Second, with the growing intermingling of monetary and fiscal policy, a further shift from private to government spending is to be feared, which will undermine economic power. And third, in the medium term there is an increased risk of inflation getting out of control.

All these factors argue against breaking the taboo on monetary public financing in the battle against the coronavirus. However, there is a risk that the central banks in the Eurozone, the US, the UK and Japan will no longer be able to afford this understanding under great political pressure.

Their countries were already weakened by the debt virus before Covid-19 hit. Now, economically speaking, they are high-risk patients.