RIO DE JANEIRO, BRAZIL – Last Wednesday, January 15th, Olivia Startup was officially released in Brazil. Developed by two Brazilians in Silicon Valley, the fintech is a financial assistant that uses artificial intelligence to learn about users’ consumption habits and help with their financial organization.

The App comes to Brazil after a round of investments of R$25 (US$6.3) million and is available at both the App Store and Google Store. The concept has been working in the United States since 2016.

Although there are a number of Apps with the premise of helping users organize financially, Olivia differentiates itself by using artificial intelligence to understand an individual’s spending routine and directing personalized tips and suggestions to each spending profile.

According to the company, during the testing stage, Olivia generated more than R$10 million in savings for users who tested the platform.

“This testing period was crucial in order to adapt the platform to the needs of Brazilians, introducing a simple and intuitive interface to the public. We spent months getting feedback until we reached this version”, comments Lucas Moraes, co-founder of Olivia.

“Furthermore, this time was fundamental for us to be able to connect to the main financial institutions in the country”, concludes Moraes.

For the time being, clients of Itaú, Banco do Brasil, Caixa Econômica Federal, Nubank and BV banks will be able to connect to the platform, as well as Alelo, CrediCard, Sodexo, Ticket, Itaucard, and American Express cards.

How it works

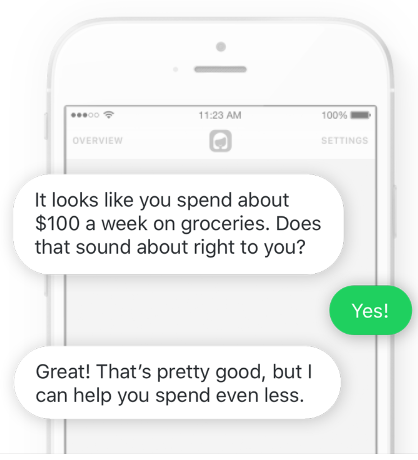

Olivia is an App that combines the functions of chatbot and financial organizer with artificial intelligence and data analysis. As soon as users open the App for the first time, Olivia asks for permission to access the bank account and financial transactions and thus learn from their shopping habits.

With use and time, Olivia gets to know users better and finds how and where they spend their money. Through artificial intelligence, the assistant can predict the next purchases and recommends the best ways to spend less and save up.

All communication between users and Olivia is conducted by chat – which even resembles WhatsApp. The tool asks questions and offers suggestions, providing users with an analysis of their financial situation. In addition, the App always encourages users to save, even if only a small slice of their salary.

The App’s role is to learn and understand users’ lifestyles and convert this information into data that evaluates spending routines so that Olivia can start looking for ways to optimize spending.

The tool is able to do price research and propose new consumption patterns to users. For instance, if users eat out regularly, the App will suggest cheaper restaurants or even search the internet for discount coupons in the restaurants most attended by users. Setting spending goals on the App is an option and Olivia helps users meet these goals.

Moreover, after saving, the App suggests some purchases that can be made with this surplus. In such cases, if the operation is performed, Olivia receives a small commission.

As the company explained, the monetization of the operation takes place mainly through this type of partnership.

For one, if Olivia realizes that a user has a consumption frequency in a certain fast-food partner network, the platform can offer an advantage, such as a discount coupon.

At that moment, Olivia will convince the company to offer the advantage, in exchange for a “commission” of 25 percent. If the discount is ten percent – or R$10 (US$2.50) – on a R$100 bill, for instance, the user will automatically pass on R$2.50 to the App.

The company reiterates that Olivia is entirely transparent with users. Whenever it offers any sponsored content or earns any commission from any transaction, users are notified.

Support makes operation possible

According to Moraes, the contribution made in the startup in the last round of investment was crucial for the service to be launched in Brazil.

The BV bank, a brand of Banco Votorantim, together with MSW Capital, a venture capital manager, through the BR Startpus fund, invested R$25 million in the operation. According to Moraes, this amount will be used to invest in technology and to expand the service in the country.

“Bringing Olivia to Brazil has always been in our plans. Last year, we tested the platform and confirmed the great potential of the Brazilian market. The contribution of BV bank, with whom we already have a partnership, no doubt, reaffirms this theory”, says Moraes.

Source: Infomoney