RIO DE JANEIRO, BRAZIL – Aiming to be part of a market that should move over US$160 billion per year until 2025, XP has launched a Brazilian stock fund focused on the international cannabis market.

Upon the legalization of the plant in several countries, whether for medicinal or recreational use, the search for investors for substances in this market has increased considerably in recent years.

Trend Cannabis FIM invests in shares of companies in countries such as the United States, Canada and England whose main raw material for their business is cannabis – popularly known as marijuana.

It is a passive fund, which follows the fluctuation of the ETF MG Alternative Harvest or, as it is better known, “MJ” (same code on the New York Stock Exchange). ETF is the largest and most fluid fund linked to the cannabis sector in the US.

The ETF is made up of companies that have more than 50 percent of their revenue tied to activities related to the Cannabis industry. They may be directly or indirectly related to the process of legal cultivation, production, marketing or distribution of products for medicinal or non-medical purposes.

The rebalancing of the ETF portfolio is carried out every three months. Today, two-thirds of investments are in the pharmaceutical sector and approximately 20 percent in the tobacco sector – the companies with the most influence in the fund are Aurora Cannabis, GW Pharmaceuticals and the Cronos Group.

The XP fund administration fee is 0.5 percent per year and there is no performance fee. The redemption is D+5 (that is, you collect the money five calendar days after the request) and the minimum investment is R$500,00.

“Trend Cannabis FIM is a diversification alternative for the individual investor who wants to have exposure to the Cannabis market. As the vast majority of companies are subject to regulatory risks in the industry and several of these are in their early stages, stock price fluctuations are usually much higher than the average for the US or even Brazilian stock market,” warned David Tarabay, XP’s fund specialist.

“That’s why XP has opted to provide the application in the fund only through an investment advisor of the brokerage house. In other words, clients who want to buy shares should talk to their advisor so that he can invest, after pondering the risks”, added the specialist.

The XP marijuana fund has a hedge (exchange protection); investors will be exposed to the price fluctuation of the ETF MG Alternative Harvest, without interference of the dollar fluctuation.

In addition to XP, management company Vitreo launched a fund in late October for the purchase of securities linked to the Cannabis sector. Vitreo Canabidiol FIA IE is open only to qualified investors – who have more than R$1 million in investments -, unlike the XP fund, available to investors in general.

Hard times for cannabis industry

Despite the billboards and bubbles of attention for cannabis business, Tyler Autera, the co-founder and COO at Cannalysis, thinks it is one of the hardest times to grow a startup within the industry.

“Regulation and compliance has brought on, in most cases, the need for larger amounts of capital from the start, which can be more difficult to come by,” he told Crunchbase News. “Expenses are higher for legal, licensing and compliance work that is now needed at the onset.”

Regardless, those complexities have brought more mature investment options.

“In the early days, [cannabis investment] was mostly angel investors/high net-worth individuals, small family offices, and small cannabis-specific VC funds,” Autera said. “Now, you see larger and more sophisticated players: large established VCs and institutional capital, coming into the space.” It means there are fewer people willing to make riskier investments, he added.

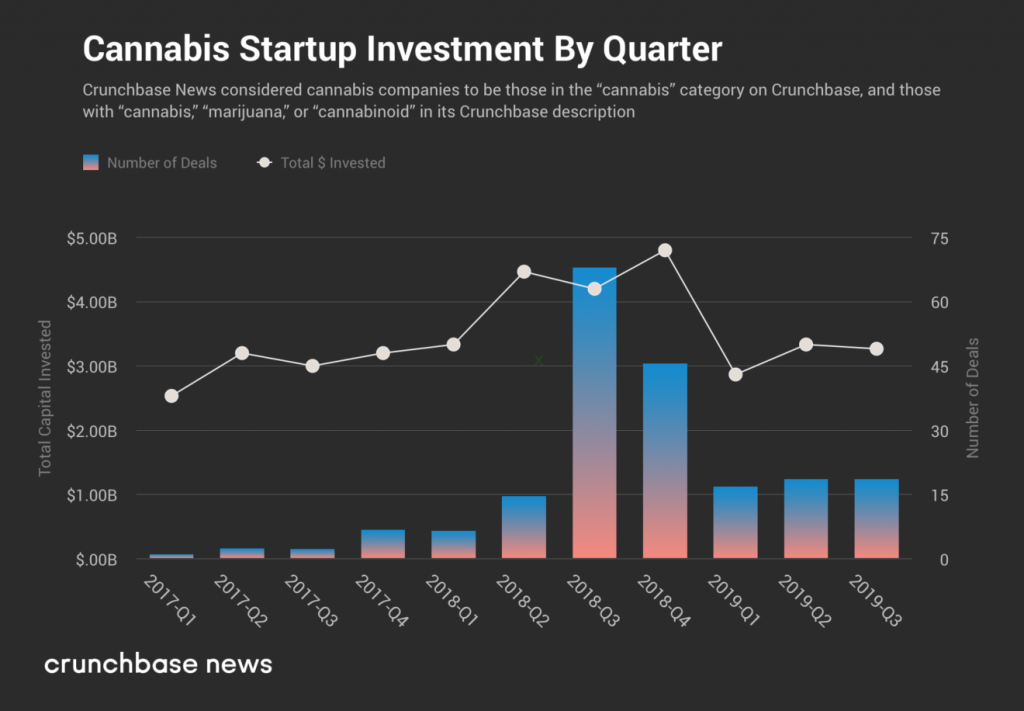

IAccording to Crunchbase data, funding for cannabis companies has slowed down dramatically from some super-giant rounds from 2018. Deal size has also decreased significantly. It is notable that private market reporting lags may account for the quarter-over-quarter decline.

Source: Infomoney, Crunchbase