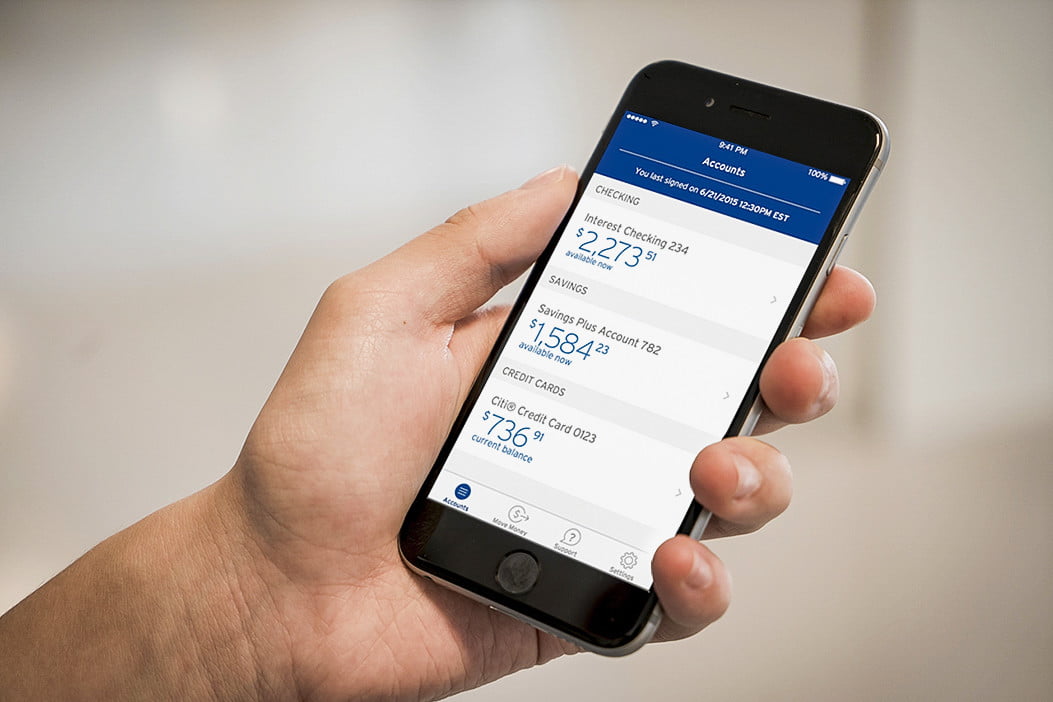

RIO DE JANEIRO, BRAZIL – A survey released yesterday, October 9th by IDC, a leading market research company, found that more than half of respondents between the ages of 18 and 49 in Colombia, Brazil, and Mexico use their smartphone to access banking and financial services. Among 30-39-year-olds, the use of the smartphone to access banking and financial services reaches 61 percent.

In Brazil, 65 percent of respondents use more their mobile app to open a bank account or access a product or service rather than personally going to a traditional branch, which totals 58 percent.

“As the survey shows, the way people interact and use financial services reflects how digitalization is changing the financial and banking markets. More than half of the sample surveyed uses smartphones to open bank accounts or purchase financial products or services, which serve as the pyramid’s base for other services in the future,” said Jay Gumbiner, IDC’s vice president of research for Latin America.

Cards

The survey also showed that 45.3 percent of Brazilians interviewed use credit and debit cards separately, while 28.6 percent hold a multiple-card (both credit and debit functions in the same card). Among the three countries analyzed, Brazil is where credit cards are used the most (57 percent), while in Mexico, according to the ranking, credit cards are used by 38 percent of respondents.

Among Brazilians, seven out of ten use their credit cards primarily for purchases over US$50 (R$200), while 39 percent say they use their debit cards for purchases below that amount.

The survey “How FinTechs and Banks Can Democratize Financial Services in Latin America” was conducted with 1,067 Class A, B, and C smartphone users from Brazil, Colombia and Mexico in May this year.

Source: Agência Brasil