RIO DE JANEIRO, BRAZIL – With the expansion of investments throughout the country in 2019, Telefônica Brasil — owner of the brand Vivo — recorded a net profit of R$2.8 billion (US$700 million) in the first half of the year, the equivalent to growth of 24.3 percent in the period. The profit in the quarter ending in June was the same as in the first quarter of the year: R$1.4 billion, with an increase of 26.4 percent over the same period in the previous year.

The results, released by the company on Wednesday, July 24th, further show that current EBITDA (earnings before interest, taxes, depreciation, and amortization) reached R$7.7 billion, with a growth of 1.9 percent. For the quarter, the figure was R$3.8 billion, up 0.2 percent over the second quarter of 2018.

With the performance of mobile service, handsets, and broadband, the company’s net revenue grew 0.4 percent in the quarter, accumulating a 1.1 percent increase in the year. Telefônica’s investment in the first six months of 2019 exceeded R$4 billion, ten percent higher than in the same period in 2018. During the quarter, the amount was R$2.4 billion, with a growth of 10.3 percent.

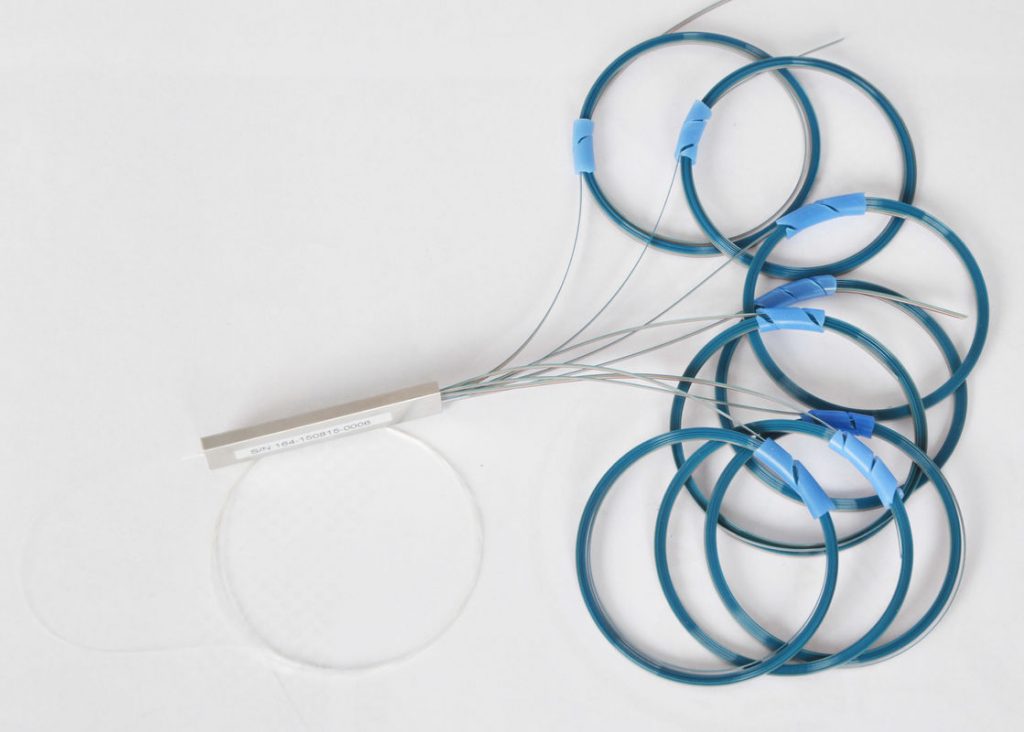

The company’s main effort has been the FTTH (Fiber-To-The-Home) network, which reached 12 new cities in the quarter. In total, 21 municipalities have been provided with the technology in the year to date. The company is also focusing on expanding the coverage and capacity of the 4.5G network.

“This year, in addition to expanding the fiber service in locations that already have Vivo’s broadband, we will reach approximately 30 new cities,” says the CEO of Telefônica, Christian Gebara, referring to the expansion of the FTTH network. He further assures that, in the mobile network, the company will remain as an isolated leader in the contract segment. “We have already reached 1,057 cities with 4.5G technology, which provides ten times the speed of the 4G network,” said Gebara.

Market leadership

Vivo remains the leader in mobile service. The company’s market share at the end of the second quarter was 32.2 percent, 7.5 percent over the second-placed competitor.

The contract customer base expanded by 8.5 percent in the period and now accounts for 56.6 percent of total mobile customers, representing an increase of 5.5 percent year-on-year. Vivo holds the leadership in this market with a 40 percent share recorded in May of this year.

Technology replacement

Vivo has been reporting a trend in the contracting of mobile plans. Customers have been choosing to change prepaid plans for the plan called “Vivo Controle”. As this is cheaper than the contract segment, the sum of the two results in a decrease in revenue in this segment, which is still offset by the total number of contracts.

“It’s a logical shift since the monthly fee is lower. Besides, the contract base is growing. In absolute figures, we saw an 8.5 percent growth”, explains Telefônica’s CEO.

In the landline segment, which is increasingly less contracted in the market, the company recorded a 2.8 percent drop in net revenue in the second quarter.

Broadband revenue offsets the landline impact: it grew 12.3 percent over the same period. The boost is due to FTTH revenue, now representing 34.5 percent of the total market.