By Richard Mann, Contributing Reporter

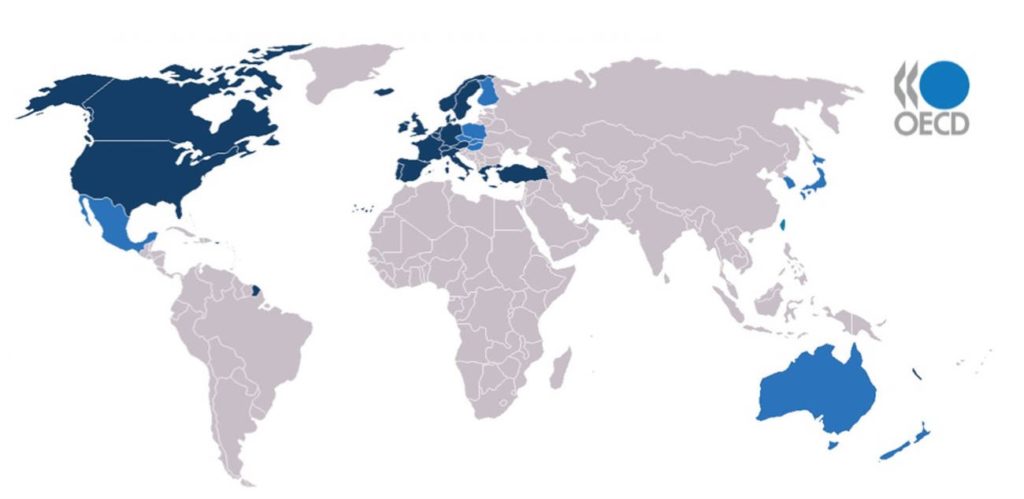

RIO DE JANEIRO, BRAZIL – Measures to simplify the regulation of foreign exchange in Brazil, mentioned on Wednesday,May 29th, by Central Bank President, Roberto Campos Neto, may facilitate the country’s admission to the Organization for Economic Cooperation and Development (OECD), according to Central Bank Director of Regulations, Otavio Ribeiro Damaso.

“We have major companies requiring numerous exchange transactions, and each operation needs to follow extensive bureaucracy. We want to review this without losing any level of security in the process,” said Damaso.

“Additionally, there are several small obstacles that prevent sending payment orders abroad in Reais.”

To join the OECD, the country needs to adopt measures that help free capital flow, and the so-called exchange rate convertibility would be one of them.

For the Real to become a convertible currency and accepted in any country in the world, like the Dollar, Euro, Pound, and Yen, the Brazilian economy needs to gain credibility in foreign markets.

It is also necessary for the international circulation of currency and transactions to gain significant volume.

Currency convertibility worked well in some countries such as Chile and Australia, but failed in Argentina in the early 2000s.

Asked about the examples of failure, Campos Neto rejected the possibility of “dollarization” of the Brazilian economy. “Most countries had equal or lower levels of volatility after allowing for free exchange rate convertibility,” he argued.

Although the project was not detailed, markets raised some of the possible consequences of changing the rules.

The president of the Brazilian Foreign Trade Association (AEB), José Augusto de Castro, believes that the measure would mainly benefit smaller companies. “Brazilian companies have been able to hold a dollar account abroad since 2006, but the cost is high,” he explains.

“With a dollar account here, the company could close a foreign exchange transaction whenever it thinks fit.”

Fernanda Consorte, foreign exchange strategist at Banco Ourinvest, believes that one of the goals of the measure is to assist economic liberalization. “Although the Brazilian economy is large, the proportion of exports and imports in the economy is small compared to other countries.”

Outside of the business environment, the measure should have little impact, benefiting those who travel abroad, who would not need to hold cash, and helping those who depend on remittances abroad.